KLTEC underperformed the broader index in 2022 (KLTEC -34% vs KLCI -5%). The latest industry average growth is downgraded to 8% for 2022 and expected to decline by 4% in 2023. Capital spending is forecasted to fall 16% YoY in 2023 due to decrease in foundry and logic investments. Weaker greenback YoY may dent the sector’s prospect. Due to PC and smartphone’s large market shares of global semiconductor demand, their weaknesses are unlikely to be offset by the strength in automotive. Downgrade the sector to NEUTRAL as we turn cautious on the sector based on the unfavourable fundamentals in the short to mid-term as well as stocks’ relatively high valuations compared to regional peers. Our top pick for the sector is the newly-initiated ITMAX (BUY, TP: RM1.70).

Underperformed in 2022. After 3 consecutive years of gain, KLTEC lost 34% vs KLCI’s 5% drop (see Figure #1) in 2022 as it underwent a sector wide major de-rating on the back of a hawkish US Fed to tame its runaway inflation and this was coupled with unsatisfactory financial results impacted by waning demand, inventory adjustment and geopolitical conflicts. Admittedly, our Overweight stance on the sector since the beginning of the year is regrettable.

Global semiconductor sales. While 10M22’s 8% YoY gain to USD487bn (see Figure #2) is on track to record another all-time high revenue for 2022, monthly YoY sales are actually down trending with contractions recorded since Jul 2022. The latest industry average growth is projected to be 8% (see Figure #3) for 2022, a significant downgrade from the +12% projection that we gathered in Jul 2022. According to WSTS, almost all product categories are expected to gain (see Figure #5) in 2022: analog (+21%) leads the pack, followed by sensors (+16%), logic (+15%), discrete (+12%), opto (+1%), more than sufficient to offset the declines in micro (-2%) and memory (-13%). As for 2023, the sector is now expected to decline by 4% (see Figure #4) instead of the earlier estimate of a 4% growth.

Equipment spending is forecasted to rise 6% YoY to reach a record USD109bn (see Figure #6) in 2022 but expected to fall by 16% to USD91bn in 2023 due to decrease in foundry and logic investments. DRAM and NAND equipment sales are expected to shrink in 2022 and 2023 as enterprise and consumer demand for memory and storage weaken. In turn, spending on backend equipment (assembly & packaging and test) are expected to soften in tandem in 2023. Similarly, the number of volume new chip-making facilities starting construction is estimated to drop from all-time-high of 33 in 2022 to 28 in 2023 (see Figure #7) despite the significant incentive boosts from government around the world to expand production capacity and strengthen supply chain (see Figure #8). We do not discount that some of the developments will be delayed or even cancelled if demand deteriorates further. Recently, it was reported that Intel is backing away from plans to start construction of a EUR17bn “mega-fab” semiconductor plant in Germany in 1H23.

Weaker greenback. HLIB expects USD to be softer in 2023 averaging RM4.34/USD compared to 2022’s average of RM4.40/USD (see Figure #9). As such, we expect tech firms to be marginally impacted as their sales are majority denominated in USD terms while partly offset by the USD cost items.

Higher input costs. Gold, aluminium, copper and steel prices are still at elevated levels despite recent weaknesses (see Figure #10) and may spell bad news for tech players. Pricier commodities will exert pressures on margins for packagers and equipment makers. However, we are not overly concerned as industry wide capacity constraint positions tech players with stronger bargaining power to pass on higher material costs.

Segmental view. Demand from automotive is expected to be robust as EV and AV require significantly higher semiconductor content. According to Gartner, this segment is estimated to record a CAGR of 17% through 2026, while electronic components spending for EV, self-driving cars, ADAS and other in-vehicle products is expected to increase 50% by 2030. However, orders for consumer-centric PC and smartphone segments are expected to ease as demand was pulled forward during pandemic and impacted by inflationary pressures. Furthermore, high-performance computing (HPC) demand is also expected to be soft as global cloud, crypto and metaverse players are on cost-cutting mode and scaling down their investments. Due to PC and smartphone’s large market shares of global semiconductor demand (>60%, see Figure #11), their weaknesses are unlikely to be offset the strength in automotive.

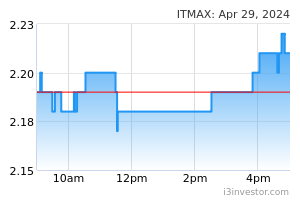

Downgrade to NEUTRAL. We turn cautious on the sector based on the unfavourable fundamentals in the short to mid-term as well as stocks’ relatively high valuations compared to regional peers (see Figure #12-13). Our top pick for the sector is the newly - initiated ITMAX.

ITMAX. Reiterate BUY with TP of RM1.70, pegged to 25x of FY24f earnings. We believe that this home-grown smart city integrated system and solution provider is a compelling case given its multi-year growth potential on the back of solid order and tender books. We also like its business model which (i) is recession-proof; (ii) creates stickiness; and (iii) recurrent revenue stream provides assurance of continuing top-line and moderates some of the lumpy nature revenue of its project-based business.

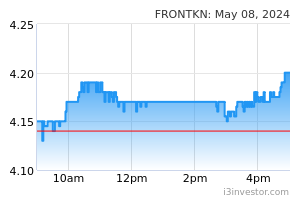

Frontken. In view of the limited upside, we downgrade to HOLD with unchanged TP of RM3.20, pegged to 30x of FY23 EPS. While Frontken is expected to experience multi year growth ahead on the back of: (1) sustainable global semiconductor market outlook, (2) robust fab investment, (3) leading edge technology (7nm and below), and (4) strong balance sheet (net cash of RM296m or 18.7 sen per share) to support its Taiwan and Singapore semiconductor expansions, we think that the risk and reward is balanced at this juncture.

Source: Hong Leong Investment Bank Research - 4 Jan 2023