We believe that oil price should remain sideways in 1H23 as we expect both demand and supply dynamics to be at parity over the next few months. With that, we lower our Brent crude oil forecast to USD85-90 per barrel for 2023 (from USD93-98 previously). Meanwhile, we also view that the petrochemical supercycle is now behind us as product spreads are seen to be coming off their respective peaks. On the other hand, we are positive on the newly-released Petronas Activity Outlook 2023-2025 as key value chains such as the Drilling Rigs, HUC/MCM and OSV segments are expected to see improved activity levels in 2023. We believe that 2023 will be a golden year for the oil and gas service providing names (OGSE) – a laggard to the elevated oil price environment for the past year. Maintain OVERWEIGHT on the Oil & Gas sector with Bumi Armada, Dayang Enterprise, Velesto Energy and Hibiscus as our top picks.

Oil demand & supply dynamics are to be at parity in 2023 and China’s reopening is a wild card. Based on our research on publications from multiple organisations such as the IEA, EIA and OPEC, we are expecting global oil demand and supply to be at parity at 100-102m bpd in 1H23. However, we highlight that global crude oil demand could see upside risk with China’s highly likely reopening in 2023. EIA forecasts global oil inventories to fall by 0.2m bpd (quite minimal) in 1H23 before rising by almost 0.7m bpd in 2H23.

Oil price forecast. We lower our Brent crude oil forecast to USD85-90/bbl for 2023 (from USD93-98/bbl previously). A weak macroeconomic environment and ample supply have knocked around USD15/bbl off benchmark crude prices in Nov. According to IEA, the sell-off comes despite: (i) lower OPEC+ production; (ii) an EU embargo on Russian crude oil coming into full force; and (iii) a relaxation of China’s Covid restrictions that could pave the way for a quicker demand recovery. Despite the seasonal slowdown in world oil demand and continued macroeconomic headwinds, recent oil consumption data have surprised to the upside – which was especially apparent in non-OECD regions, including China, India and the Middle East.

Petrochemical down-cycle to continue in 2023. Based on our recent analysis on PCHEM (HOLD – TP: RM9.20) and Lotte Chemical Titan (NOT RATED), we view that the petrochemical super-cycle is now behind us as product spreads are seen to be coming off their respective peaks due to the following reasons: (i) additional new supply globally (Figure 3) – which shows the following increase in total global capacity (Ethylene: 9.9%; HDPE: 13.2%; LDPE: 2.3%; LLDPE: 10.0%; PP: 8.4%); (ii) shortterm supply shortage has been normalising; and (iii) limited demand growth amidst high commodity prices worldwide and stagflation risks. We advise investors to avoid the downstream petrochemical names amidst the likely outcome of a petrochemical bear cycle in 2023.

Below Are the Key Takeaways From the Newly-released Petronas Activity Outlook 2023-2025 Report.

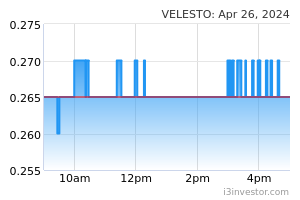

Drilling Rigs and HWU. Petronas expects an average of 26 rigs (an increase of 30% YoY) to be chartered in 2023 (12 Jack-up rigs, 4 Tender rigs, 8 Hydraulic Workover Units, 2 semi-sub/drillships) as compared to 20 rigs (9 jack-up rigs, 3 tender rigs, 6 Hydraulic workover units, 2 semi-sub/drillships) in 2022. We highlight the clear beneficiary of this development would be Velesto Energy in our local space.

OSV. The big picture outlook for OSVs is expected to increase slightly in 2023 as there are a total of 351 support vessels (Production: 147, Drilling: 204) expected to be chartered throughout the year as compared to 339 support vessels (Production: 166, Drilling: 173) in 2022. However, we understand that the daily charter rates for OSVs across the board have been on the rise (and still so) backed by the lack of supply of available vessels in the market over the years of underinvestment. This will bode well for names like Perdana Petroleum and Icon Offshore.

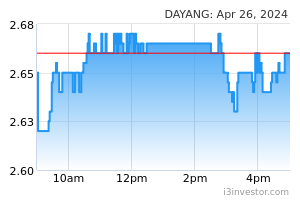

HUC and MCM. Significantly higher HUC and MCM man-hours are expected for 2023 (HUC: 5.0, MCM: 11.9) as compared to 2022 (HUC: 3.4, MCM: 8.7). This translates to an expected sizable increase of 47% and 37% YoY for both HUC and MCM activities in 2023. We highlight that the clear beneficiary of this development would be Dayang Enterprise, Petra Energy and Carimin Petroleum.

Winners. We highlight a few key value chains that stood out as clear winners throughout the Petronas Activity Outlook 2023-2025 report such as the Drilling Rigs, HUC/MCM and OSV segments – which we believe will benefit Velesto Energy (BUY – TP: RM0.17), Dayang Enterprise (BUY – TP: RM1.71), Perdana Petroleum (NOT RATED) and Carimin Petroleum (NOT RATED).

Losers. No Clear Losers.

Overall. We are positive on the Petronas Activity Outlook 2023-2025 report as most of the value chains are expected to see improved activity levels in 2023 from 2022. We believe that 2023 will be a golden year for the oil and gas service providing names (OGSE) – a laggard to the elevated oil price environment for the past year.

Petronas capex and outlook. We expect Petronas capex spending to be maintained at the RM40-50bn level annually over the next 3 years (2023-2025), with about 15% of its annual capex allocated to renewable energy initiatives. Petronas has pledged to a net-zero carbon emission goal by 2050, but still believes that oil and gas would still form 50% of the world’s energy mix for the next 20 to 30 years.

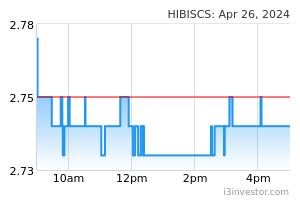

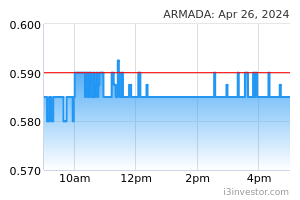

Maintain OVERWEIGHT. Our top picks for the sector are: (i) Velesto Energy (BUY; TP: RM0.17) as we believe that it will successfully turn the corner in 4Q22 and in 2023 as we foresee its blended rig utilisation rates to be healthy amidst the pick-up in drilling rig jobs throughout the year; (ii) Bumi Armada (BUY; TP: RM0.88) given its foothold in the FPSO business which provides steady recurring income, coupled with speedy enhancement in its debt profile and undemanding valuations; (iii) Dayang (BUY; TP: RM1.71) as it serves to be a direct beneficiary of increasing OSV charter rates and higher guided MCM and i-HUC man hours (from Petronas Activity Outlook 2023); and (iv) Hibiscus (BUY; TP: RM1.56) as we strongly believe that investors have not priced in the exquisite prospects of Hibiscus’s profits and cash flows in the upcoming quarters – mainly from additional sales and production volumes from the completed acquisition of FIPC (Repsol) assets in Jan 2022.

Source: Hong Leong Investment Bank Research - 20 Dec 2022