9M22 core net profit of RM1.7bn (+2%) came in within our expectation, accounting for 71.2% of our full-year estimate. We tweaked our FY22-23 net profit forecasts lower by 2.7-19.0%, mainly to reflect lower CPO price assumptions, lower FFB yield assumption, and higher margin assumption at downstream segment. FY24 core net profit forecast is raised by 17.7%, to reflect higher EBIT margin assumption at downstream segment. Post earnings revisions, we maintain our HOLD rating on SDPL with a higher TP of RM4.49.

In line with ours; below consensus. 3Q22 core net profit of RM365m (-39% QoQ; -47% YoY) took 9M22 total sum to RM1.7bn (+2%). We consider the results within our expectation, accounting for 71.2% of our full-year estimate. Against consensus, the results came in below, accounting for only 64%.

EIs in 9M22. Core net profit of RM1.7m was arrived after adjusting for (i) RM188m fair value loss on commodities futures contracts and forward foreign exchange contracts, (ii) RM291m disposal gains, (iii) RM113m impairment, write-off, and writedown, (iv) RM51m unrealised forex loss, and (v) RM105m fair value loss on biological assets.

QoQ. Core net profit fell by 39% to RM365m in 3Q22, dragged by significantly lower realised palm product prices and higher finance cost (arising from the continued increase in benchmark lending rates), but partly mitigated by a 4% increase in FFB output (led mainly by an 8% increase in FFB contribution from Indonesia) and improved downstream contribution.

YoY. Core net profit fell by 47% to RM365m in 3Q22, dragged mainly by lower contribution from upstream segment (arising from lower FFB output, OER, and realised PK price, but partly mitigated by higher realised CPO price) and higher finance cost, which more than offset improved contribution from downstream segment (thanks to higher margins generated by Asia Pacific bulk and differentiated operations).

YTD. 9M22 core net profit increased marginally (by 2%) to RM1.7bn, as lower FFB output (-12%), higher CPO production cost and finance cost were more than mitigated by higher realised palm product prices and improved contribution from downstream segment. Despite lower sales volume (-4%), operating profit at downstream segment surged 1.7x to RM711m in 9MFY22, as lower sales volume was more than mitigated by higher margins across its Asia Pacific businesses.

FFB output. FFB output fell by 12% to 6.1m tonnes in 9M22, dragged mainly by acute labour shortfall in Malaysia, which has in turn resulted in FFB output in Malaysia falling by 26% to 2.65m tonnes. Despite having brought in 1,700 new workers since Jun/Jul and expected inflow of another 1,300 new workers by end-2022, management expects FFB output in Malaysia to improve only from 2Q23 onwards, as it takes time to train new workers and rehabilitate its estates in Malaysia.

Forecast. We lower our FY22-23 core net profit forecasts by 2.7-19.0%, mainly to reflect (i) lower CPO price assumption of RM5,050/mt (vs. RM5,500/mt earlier), lower FFB yield assumption in Malaysia, and higher EBIT margin assumption at downstream segment for FY22, and (ii) lower CPO price assumption of RM4,000/mt (vs. RM4,500/mt earlier) and higher EBIT margin assumption at downstream segment for FY23. We raise our FY24 core net profit forecast by 17.7%, to reflect higher EBIT margin assumption at downstream segment.

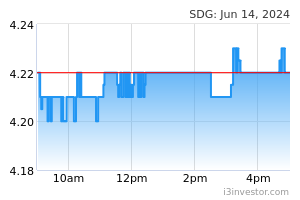

Maintain HOLD with higher TP of RM4.49. Post earnings revisions, we maintain our HOLD rating on SDPL with a higher TP of RM4.49 based on 18x revised FY24 core EPS of 24.9 sen.

Source: Hong Leong Investment Bank Research - 23 Nov 2022