Axis REIT has proposed a private placement of up to 100 million units, representing approximately 6.1% of its outstanding units. The RM178m proceeds are earmarked for repayment of bank financing. With this development, its gearing ratio will be reduced to 31% (from 36%). The new shares will dilute its FY23f core EPU by 1.5% as a 6.1% expansion in the share base more than offset a 4.5% earnings enhancement arising from interest savings. We opine that the reduction in gearing ratio provides greater headroom for Axis REIT to undertake further acquisitions of earnings accretive assets. We are neutral on this development and maintain our BUY call with an unchanged TP of RM1.99.

NEWSBREAK

Axis REIT has proposed a private placement of up to 100 million units, representing approximately 6.1% of its outstanding shares at an indicative price of RM1.78/unit. The RM178m proceeds from this exercise are primarily earmarked for repayment of bank financing.

To recap, this corporate exercise marks Axis REIT’s second cash call after the completion of a private placement on 20 Dec 2021, which raised gross proceeds of RM334.7m for the same purpose – repaying bank financing.

HLIB’s VIEW

Financial position. Based on our estimates, the gross proceeds of RM178m will reduce its net debt position to c. RM1.3bn from RM1.4bn as at 30 September 2022 while gearing ratio shall reduce to 31% (from 36%).

Neutral. From our calculations, the new shares will dilute its FY23f core EPU by 1.5% as a 6.1% expansion in the share base more than offsets a 4.5% earnings enhancement arising from the interest savings. Assuming the deal is to be completed, our target price shall fall to RM1.96 based on the same valuation basis. Notwithstanding, the reduction in gearing ratio provides greater headroom for Axis REIT to increase its leverage in a bid to undertake further acquisitions of earnings accretive assets. We also note that this development is paving way for Axis REIT to achieve its acquisition targets with total estimated value of RM120m in the coming quarters. On balance, we are neutral on this development.

Forecast. We maintain our forecast pending completion of the proposed private placement.

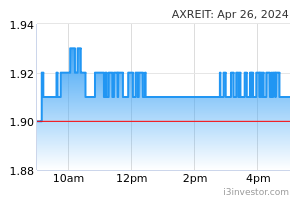

Maintain BUY, TP: RM1.99. We maintain our BUY call with an unchanged TP of RM1.99. To note, our TP is based on FY23 DPU on targeted yield of 4.8% derived from -1SD below 5-year historical average yield spread between Axis REIT and 10Y MGS, in view of its robust track record, occupant tenancy in its diversified portfolio, resilience amidst tough times, as reflected by their performance at the height of the Covid-19 pandemic. Also, it is also one of the few Shariah compliant REITs.

Source: Hong Leong Investment Bank Research - 15 Nov 2022