An integrated engineering support service provider. Listed on the ACE Market in Jan 2022, CORAZA is an integrated engineering support services provider with two main business segments: sheet metal fabrication and precision machining. The group serves a variety of anchor customers from semiconductor (58.5% of FY21 revenue), instrumentation (18.6%), life science & medical devices (16.0%), aerospace & others (6.9%) sectors. CORAZA has built longstanding relationships with customers J, P, and A (listed on NYSE/NASDAQ), collectively accounting for c.68% of its FY21 sales.

To stay resilient. Notwithstanding the economic slowdown and demand correction in consumer products that lead to a sluggish semiconductor sales outlook, we opine front - end players will stay resilient, premised by strong semiconductor investments (RM52bn over the past 12 months). Factors such as the “China+1” strategy and Malaysia’s well established semiconductor ecosystem should continue to attract FDIs going forward, especially when many countries have rushed to develop their semiconductor capabilities to be self-sufficient on the back of national strategic and security interests. In our recent meeting with SIA, we gathered that the semiconductor expansion plans that were announced over the past two years in Malaysia remain intact, with equipment lead time remaining long. Interestingly, SEMI expects Southeast Asia’s 2023 fab equipment spending to be record high despite anticipating global equipment spending to contract by -2% YoY.

Paving way to Main Market listing. After achieving the Main Market profit track record requirement (3-5 full financial years with an aggregate PAT of RM20m, with the latest full financial year having at least RM6m PAT), CORAZA is mandated to allocate 12.5% of its enlarged number of share issued to Bumiputra investors approved by MITI. Though this corporate exercise comes at the cost of earnings dilution, this will indirectly pave the way for the Main Market listing, allowing CORAZA to gain access to a wider investor base.

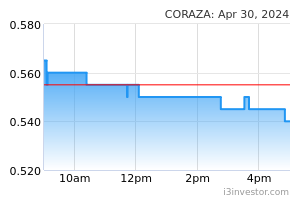

Grossly oversold. Technically, CORAZA is grossly oversold and with indicators on the mend. A successful breakout above RM 0.66 will spur greater upside toward RM0.71- 0.76-0.80. Cut lost at RM0.54.

Source: Hong Leong Investment Bank Research - 8 Nov 2022