MISC recorded 2Q22 core net profit of RM267m (-29% QoQ, -41% YoY) and 1H22 core net profit of RM638m (-28% YoY). We deem the results to be below expectations at 32%/35% of our/consensus full-year forecasts. Key variance against our estimates was mainly due to: (i) a one-off compensation of RM45m for a contract negotiation for its petroleum tanker segment; and (ii) cost overrun from its Mero 3 FPSO due to the lockdown in Shanghai and global supply chain issues. We trim our FY22-24f net profit forecasts by 25%, 14% and 9% respectively mainly to reflect lower profit margin assumptions for its offshore segment. All-in, we maintain HOLD on MISC with a lower TP of RM7.39/share. We think that downside is supported for MISC due to its: (i) defensive nature from its portfolio of long-term charters which will provide consistent and recurring cash flow s; and (ii) its relatively fixed dividend payout policy of 33 sen/year (4.8% yield).

Below expectations. MISC recorded a 2Q22 core net profit of RM267m (-29% QoQ, -41% YoY) and 1H22 core net profit of RM638m (-28% YoY) after having adjusted for: (i) RM9.5m gain on disposal of ships; (ii) RM1.6m of write-offs of ships & PPE; (iii) RM31.2m of write-back of impairment loss; (iv) RM21.2m impairment loss on receivables; and (v) RM309.8m impairment of non-current assets. We deem the results to be below expectations at 32%/35% of our/consensus full-year forecasts. Key variance against our estimates was mainly due to: (i) a one-off compensation of USD45m for a contract negotiation for its petroleum tanker segment; and (ii) cost overrun from its Mero 3 FPSO due to the lockdown in Shanghai and global supply chain issues.

Dividend. Second interim dividend of 7.0sen/share (ex-date: 2 Sept 2022, payment: 14 Sept 2022) was declared, bringing 1H22 DPS to 14 sen/share, which was well expected.

QoQ. 2Q22 core net profit was down 29% QoQ, attributed to: (i) increase in construction costs for Mero 3 FPSO due to global supply chain issues and Shanghai’s lockdown; (ii) lower contribution from its associates and JV; (iii) significantly higher finance costs throughout the quarter and (iv) a one-off compensation of USD45m for a contract negotiation for its petroleum tanker segment.

YoY/YTD. 2Q22 core net profit was down 41% YoY while 1H22 core net profit was down 28% YoY due to similar reasons mentioned in the QoQ paragraph.

Outlook. We are expecting upcoming quarters to be better due to: (i) elevated petroleum tanker rates attributed to the increase in oil production globally as the group guided that the demand and supply dynamics of oil & gas would continue to be healthy; and (ii) no more provisions for its Mero 3 FPSO. Term to spot portfolio mix for its petroleum segment stood at: (i) VLCC (70:30); (ii) Suezmax (42:58); and (iii) Aframax (69:31). We understand that Mero 3’s completion stands at 48% as at end June 2022 and provisions have been done for a delay of 6 months (till mid-2024). MISC is also a beneficiary of stronger USD as most of its receivables are in USD.

Forecast. We trim our FY22-24f estimates by 25%, 14% and 9% respectively mainly to reflect a lower profit margin assumptions for its offshore (Mero 3 FPSO) segment.

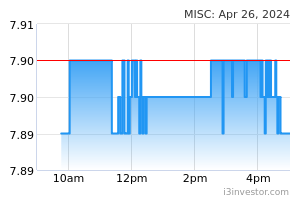

Maintain HOLD, lower TP to RM7.39/share. With narrowed upside to our revised SOP-derived TP of RM7.39 (from RM7.67), we maintain HOLD on MISC. However, we think that downside is also supported for MISC due to its: (i) defensive nature of the name due to its portfolio of long-term charters which will provide consistent, recurring cash flows; and (ii) its fixed dividend payout policy of 33sen/year.

Source: Hong Leong Investment Bank Research - 19 Aug 2022