MARKET REVIEW

Asia/US. Asian markets ended mixed as investors digested China’s slower PMI manufacturing and expanding services reports in July, on the heels of Covid-19 flare-ups, slowing global demand and property market risks. After rallying 3% WoW, Dow fell as much as 205 pts intraday before paring the losses to 47 pts at 32,798 as investors weighed the July ISM Manufacturing data (52.8, June: 53, forecasts: 52), which grew for a 26th straight month but at the weakest rate since June 2020. Overall, key focus will be on the July jobs data on Friday (consensus: +250k) as it could impact the calculus for Fed’s monetary policy. Earnings wise, key results slated are AMD, Starbucks, Warner Bros and Caterpillar.

Malaysia: Tracking upbeat cues from Wall Street last Friday and a resumption of foreigners’ net inflows, KLCI soared 9.8 pts to 1,502.1, led by gains in TENAGA, IHH, IOICORP, KLK, PCHEM, and CIMB. Market breadth (gainers/losers) remained bullish at 1.54 vs 1.45 last Friday. Retailers (-RM28m, 5D: -RM97m, YTD: +RM1.51bn) and local institutions (-RM17m, 5D:-RM62m, YTD:-RM7.76bn) were the major net sellers whilst foreigners (+RM45m, 5D: +RM159m, YTD: +RM6.25bn) logged net buying trades for the 4th consecutive Session.

TECHNICAL OUTLOOK: KLCI

As anticipated, KLCI finally closed above the long-awaited 1,500 psychological mark after staging a bullish neckline resistance breakout above 1,475 and refilled the 1,483-1,493 gap last Friday, which may increase the odds to retest 1,512 (50% FR), 1,528 (100D MA) and 1,536 (200D MA) next. Immediate support is reset higher to 1,475-1,487 (38.2% FR). Failure to defend these levels could trigger selldown towards 1,457 (23.6% FR) and 1,446 (20D MA) levels, acting as stronger support buffers.

MARKET OUTLOOK

Given KLCI’s recent bullish breakout and technical indicators, the index could trend higher to revisit 1,512 (50% FR), 1,528 (20D MA) and 1,536 (200D MA) levels next but we should brace for an interim pullback after surging 94 pts from YTD low of 1,408, ahead of the wide focused Aug results season.

VIRTUAL PORTFOLIO POSITION-FIG1

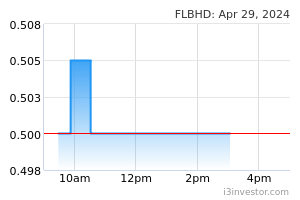

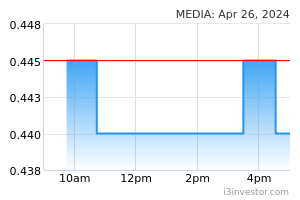

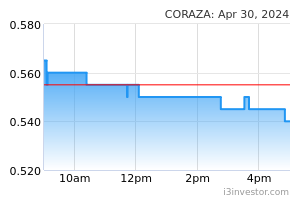

Riding on the strong rally, we decided to take profit on our remaining stocks recommended in June i.e. FLBHD (16.1% gain), CORAZA (8.3% gain) and MEDIA (16.7% gain).

Source: Hong Leong Investment Bank Research - 2 Aug 2022