A victim of Covid-19. Listed in the Main market since 2014, OWG Berhad (OWG) is an investment holding company that manages and operates F&B and leisure-related brands found in popular resorts and shopping malls. The group's F&B outlets, water amusement parks, and family attractions are strategically located in tourist attractions, such as Genting Highlands, Komtar Tower at Penang and Klang Valley. As the group business is primarily involved in the tourism industry, the onset of Covid-19 has heavily affected the group's operation. The decline of business volume from its Food service operation as well as the Amusement and recreation operation has whipped 79% of its FY19 revenue of RM123m to RM25m in FY21. In turn, the group chalked into red in FY20 (the first loss-making FY since it was listed), and the loss expanded further to RM42m in FY22. Nonetheless, we see the return of tourism following Malaysia's transition toward endemicity as a turning point for OWG as it will drive more footfall to its F&B outlet and family attractions.

A comeback. As of 21 June, Malaysia has already surpassed its full-year target of 2m incoming tourist arrivals. Genting Highlands, where most of its outlets are located and made up 40% of OWG's bottom line back in 2019, has seen its footfall gaining traction supported by (i) pent-up demand for travel, (ii) the depreciation of ringgit, and (iii) the launches of GentingSkyworld theme park. We flag that the group turnaround 3QFY22 (report until 31 March) had yet to reflect the strong return of foreign tourists as Malaysia only reopened its international border on 1 April 2022. In view of solid recovery momentum (2H seasonally stronger earnings), we expect greater business volume in its F&B outlet and family attractions and thus better earnings going forward.

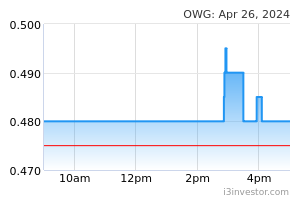

Trading near its uptrend support. Technically, OWG is trading near its uptrend channel support of RM0.45-0.49, with indicators showing uptick bias. In light of the higher highs pattern, a decisive breakout above RM0.50 will spur prices higher towards RM0.56-0.62-0.74 territory. Cut loss at RM0.40.

Source: Hong Leong Investment Bank Research - 26 Jul 2022