MARKET REVIEW

Global. After slumping 7.7% in the last 9 days, MSCI All Countries Asia Pacific index staged a 1.5% relief rally to 158.75 as investors weighed a Covid-19 outbreak in Shenzen and Fed President Bullard’s hawkish remarks, as well as seeking further policy clarity from Powell’s speeches to the House on Wednesday and Thursday. After sinking 3,101 pts or 9.4% in the last 13 trading sessions in June, Dow staged a 2.2% oversold rebound to 30,530, as investors piled into beaten-down energy and growth stocks ahead of the widely focused Powell’s two-day semi-annual Congressional testimony after the Fed hiked rates by 0.75% last week.

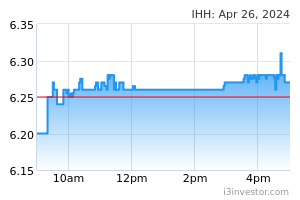

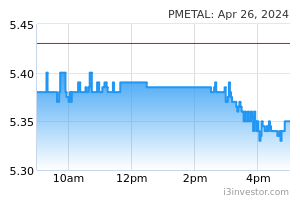

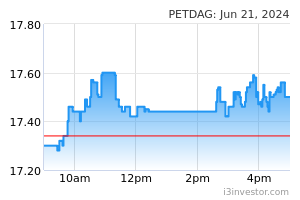

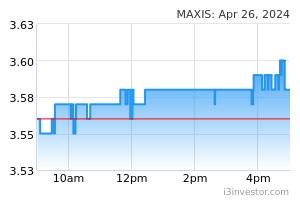

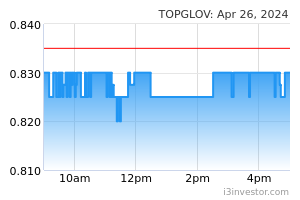

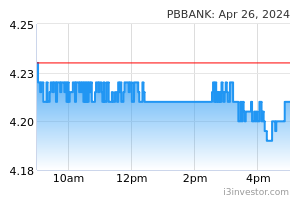

Malaysia. Tracking a relief rally in regional markets, KLCI jumped 16.6 pts to 1,457.9 after plunging 129 pts in June, led by a resumption of foreign net inflows and bargain hunting activities on bashed-down heavyweights i.e. IHH, PMETAL, PETDAG, MAXIS, TOPGLOV and PBBANK. Market breadth (gainers/losers) soared to 2.25 from 0.27 a day before. After net selling RM931m in 11 days out of 13 sessions in June, foreign institutions returned as net buyers (+RM133m, 5D: -RM241m; YTD: +RM6.57bn) vis-à-vis net selling trades by local institutions (-RM125m; 5D: +RM77m; YTD: -RM7.96bn) and retail investors (-RM8m, 5D: +RM164m; YTD: +RM1.39bn).

TECHNICAL OUTLOOK: KLCI

After sliding 129 pts in June, KLCI finally staged a long-awaited 16.6-pt technical rebound to 1457.9. As technical readings are on the mend, KLCI could build on the momentum to gain further towards 1,476 (10D MA), 1,483-1,493 gap and 1,500 zones. Key support is situated at 1,400, 1,420 and 1,437 territory.

MARKET OUTLOOK

Bursa Malaysia is set for a boost today following a relief rally from Wall St overnight but the durability of the rebound is in doubt and volatility prevails (major supports: 1,395-1,420- 1437) as investors await more policy clarity from Powell’s two-day semi-annual Congressional testimony. Hence, any oversold rebound may face stiff hurdles at 1,483- 1,493 zones as investors recalibrate risks around (i) elevated inflation, (ii) potential capital outflows amid aggressive Fed and QT, (iii) protracted Russia-Ukraine war, (iv) heightened US-China conflict and (v) political fluidity amid speculation of GE15 in 2H22.

Source: Hong Leong Investment Bank Research - 22 Jun 2022