E-service provider. Listed in 2005, MYEG is Malaysia’s leading digital services company, providing a wide range of government (concession) and commercial services. These services include facilitating online payments for government services such as the renewal of vehicle road tax, foreign worker permits, and digital health travel pass system. Over the years, MYEG has been entrusted by the Malaysian government to provide vital services for JPJ, JIM, KKM, and more. Beyond Malaysia, MYEG has expanded its footprint into the Philippines, Indonesia, and Bangladesh markets.

Still growing strong. Although the contribution from MYEG's healthcare segment is expected to taper off following the gradual removal of Covid-19 SOPs (no quarantine or testing needed for fully vaccinated tourists), we believe this will be cushioned by MYEG's immigration segment as well as the road transport segments, which are deemed to be a prime beneficiary of border reopening. In particular, MYEG Immigration segment's matching and permit renewal services will likely to get a strong boost following the return of foreign workers amid acute labour shortages across most sectors. This is reflected by the group's strong 50k backlog orders for its foreign workers' matching services (vs. 24k headcount per year during pre-pandemic).

Also, with the commencement of the proof of concept (POC) for the automated driving test and training system, the official rollout of JPJ's e-testing system is expected to deliver ~RM50-60m earnings p.a. to MYEG. On the other hand, Zetrix's Blockchain-chain cross border trade service platform that is slated to launch by July will allow MYEG to monetize Zetrix by charging gas fees on transactions, tracking fees on the supply chain traceability, as well as transaction fees on cross-border trades

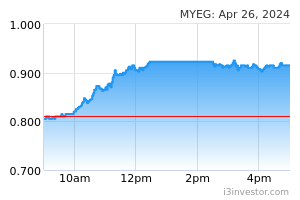

Grossly oversold. After plunging -20% YTD, MYEG is currently trading at an undemanding 16.7x FY23 P/E (33.2% lower than its pre-pandemic 5-year average of 25x). Technically, the hammer pattern formation on 17th June coupled with the oversold RSI indicate a potential rebound going forward. A successful breakout above RM0.90 will spur the prices toward RM0.92-0.96-1.00. Cut loss at RM0.79.

Source: Hong Leong Investment Bank Research - 22 Jun 2022