MARKET REVIEW

Global. Prior to the release of March FOMC minutes tonight, Asian markets ended mixed as investors grappled with the prospects of (i) China’s slowing economy will bolster the case for further policy easing following an extended Covid-19 lockdown in Shanghai; (ii) the progress toward resolving an audit dispute that would threaten US -listed Chinese firms with delisting on NYSE, as well as (iii) additional Western sanctions on Russia following alleged war crimes in Ukraine. The Dow tumbled 281 pts to 34,641 whilst Nasdaq slid 328 pts to 14,204 after Fed Governor Brainard set a more hawkish tone that Fed will continue tightening monetary policy methodically through a series of interest rate hikes and more rapid balance sheet runoff as soon as the 3-4 May meeting. Sentiment was also roiled by further sanctions on Russia by the US allies due to outrage over possible war crimes.

Malaysia. KLCI eased 2.1 pts at 1,596.8 to log a 2nd straight fall, mainly led by retracements in banking stocks amid lingering concerns of Sapura Energy’s debt restructuring plan, which is saddled with RM10.3bn in loans from nine banks. However, market breadth stayed positive with 653 gainers vs 308 losers whilst total turnover and value jumped 14.5% and 15% to 3.87bn shares worth RM2.37bn, respectively. Foreigners remained the major buyers with net inflows of RM63m (YTD: +RM6.81bn) whilst the local institutions and retailers were major sellers with net outflows of RM46m (YTD:-RM7.02bn) and RM17m (YTD: +RM205m), respectively.

TECHNICAL OUTLOOK: KLCI

Despite the mild profit taking of 5.6 pts in two days, we remain constructive of near term KLCI outlook in wake of the decisive close above multiple key MAs. We would only turn negative if the index retreat below key supports at 1,575-1,585 levels again, which may trigger further selldown towards 1,565 (uptrend line) and 1,546 (200D MA) zones. Key resistances are pegged at 1,600-1,620 (YTD high)- 1,642 (14M high).

MARKET OUTLOOK

Barring any decisive breakdown below 1,565-1,575 supports, KLCI is expected to march higher in April towards 1,606-1,620-1,642 levels after a brief consolidation, underpinned by (i) Malaysia’s relative appeal amid the geopolitical conflict, (ii) transition to endemicity, (iii) possible “election rally”, and (iv) April is historically a good month for KLCI (average +1.6% growth in the last 20 years). Key risks ahead are a prolonged Russia-Ukraine war, extended Shanghai lockdowns, elevated inflation, and a hawkish Fed.

VIRTUAL PORTFOLIO POSITION-FIG1

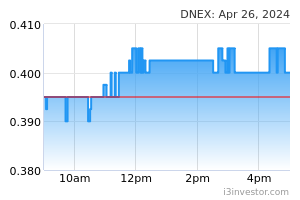

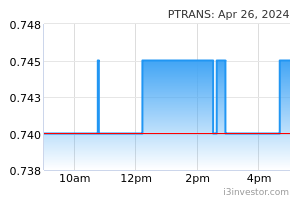

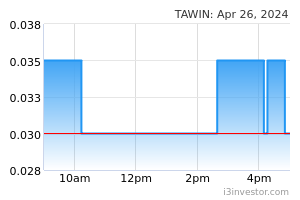

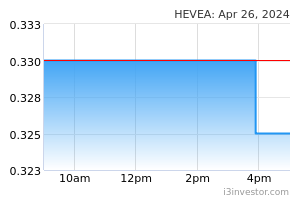

After hitting our respective target prices, we decided to take profit on DNEX (11%), PTRANS (11.9%), TAWIN (13.8% gain) and HEVEA (9% gain) on 5 April.

Source: Hong Leong Investment Bank Research - 6 Apr 2022