7 Key Findings I Discovered in ARB Berhad Quarterly Results

There seems to be a lot of discussion surrounding ARB in the forums, and they are indeed a company that many investors may come across due to their low valuations.

We will discuss in depth on what is happening in ARB in their 5th quarterly report for the financial year ended 2022.

Item #1. Revenue Generated

For the 5th quarter ended 31st March 2022, ARB had generated RM137.22 million in revenue, where no comparative quarters on a year-to-year basis were available due to a change in their financial year end. Nevertheless, one could benchmark their 5th quarter to 1st quarter in financial year 2021, where the revenue was only RM49.48 million.

The growth were considered substantial for ARB on a year-to-year basis.

The groups’ revenue increased by a marginal 1% without specification on ERP or IoT growth on a quarter-to-quarter comparison basis. Nevertheless, the revenue generated by the company is consistent at this juncture.

Item #2. Profitability

I wanted to bring your attention to Note B10., where there are serious expenses coming from their impairment loss on intangible assets and reversal of negative goodwill.

The financial performance of ARB could be much better if not for the one-off items. Therefore, we as investors must take this abnormal period and normalize it.

Based on my preliminary calculations, the actual profit before tax should be RM69.16 million, and this should translate into 7.47 cents. This represents significant growth on both year-to-year and quarter-to-quarter comparison basis.

Item #3. ICPS Dilution

Based on the strike value of RM0.140 per share for the ICPS of the company, I reckon there will be minimal conversion at this moment as long as the price of the company remains below RM0.165, a pro-forma calculation based on current ICPS price and strike value.

Hence, not much fund were raised in the said period.

Item #4. Trade Receivables, Inventories

As you may already aware, ARB is more of a software and services-based company. There is a minimal increase in inventories of RM0.55 million from 31st December 2020, but this should be negligible judging from the turnover of the company.

The trade receivables however, increased from RM68.23 million to RM197.10 million from 31st December 2020 to 31st March 2022. I believe this shouldn’t be alarming to investors given the revenue base increased as well as hidden profit generated by the company.

So far, nothing was flagged yet.

Item #5. Cash Flow

For the 5 quarters consolidated for financial year 2022, ARB had a positive operating cash flow of RM52.95 million, which is impressive given how the market had been viewing the cash flow statement of ARB negatively.

In the meantime, the company had also raised RM72.98 million via rights issue. I do not foresee any potential cash call coming from the company anytime soon.

As at 31st March 2022, the company is holding RM84.16 million of cash on hand.

Item #6. Prospects

Nothing much to comment, so I would like to cite what the management had mentioned in Note B2.

“ERP and IoT segments are expected to contribute impressive future earnings for the Group.”

Item #7. Valuation

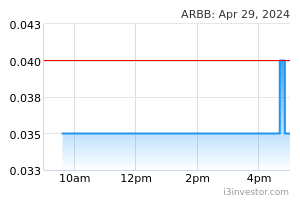

On an adjusted basis, the valuation of ARB is still on the low side, where this main market software company is trading at a mere 1.73 times PER. I believe this is caused by i). Lack of understanding on the core business, ii). Hard-to-understand financial reports and iii). Fear of dilution from ICPS. Nevertheless, these problems are time-adjusted and they would solve automatically in the future. Hence, I would like to personally issue a strong buy call on ARB by pegging a 5 times PER on the adjusted TTM EPS of the company of 18.58, which would translate to a share price of RM0.930~, representing a 87.08% margin of safety on the current price.