LUXCHEM (5143) is a Main Market company in the Industrial Products & Services segment, specifically in chemicals.

LUXCHEM has 2 main businesses:

1. Trading (Import & export of petrochemical & other related products):

Trading products are mainly sold to manufacturers in the Latex, Fibreglass Reinforced Plastic (“FRP”), Polyvinyl Chloride (“PVC”), Rubber, Coating and Ceramic industries.

29% of Trading revenue (before inter-segment revenue) for FY 2021 was exports.

2. Manufacturing

There are 3 types, making & trading of:

(a) Unsaturated Polyester Resin (UPR);

(b) Latex chemical dispersions, latex processing chemicals & specialty chemicals (for rubber gloves industry); and

(c) Former cleaning agents, powder free coagulants and polymer coatings. (for rubber gloves industry)

41% manufacturing segment revenue (before inter-segment revenue) was exports. (Vietnam, Thailand, China, Indonesia, etc)

Trading segment still contributed more to revenue & profit.

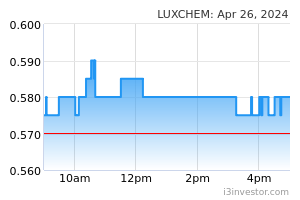

Is LUXCHEM selling at cheap price now?

1. Share price you pay is lower than Price to Book.

LUXCHEM's share price is RM 0.485, whilst its net assets is about RM 0.55.

2. Best performance in FY2021.

LUXCHEM's revenue hit all-time high in FY2021. Net profit hit a high in the same year. Share price all-time high was in Aug 2020 around RM 1.20. FY2022 had generally been on a QOQ downtrend, similar to glove companies.

3. Financial Statements.

LUXCHEM usually has positive net cash from operations each quarter. LUXCHEM is a net cash company with little debts. LUXCHEM has given dividends annually as far back as 2009.

4. Insider dealings.

Managing Director & Executive Director bought shares last year.

5. PE ratio is around 11 (trailing 4 quarters).

LUXCHEM's trailing PE ratio is low. However, it is believed the low PE is due to negative growth in recent quarters.

I don't have LUXCHEM shares. Suppose LUXCHEM produces an average net profit to shareholders of 12.5mil./quarter, given PE ratio of 12, LUXCHEM should be worth RM 0.56.