PIE (7095) is a Main Market company in the Industrial Products & Services segment.

PIE is a company that some know of.

PIE is a fully integrated "one-stop" EMS company that also manufactures wires & cables. Most of its revenue comes from Malaysia. EMS contributes 81%, Raw wire & cable manufacturing is around 17%. Wire harness & cable assembly is about 2%.

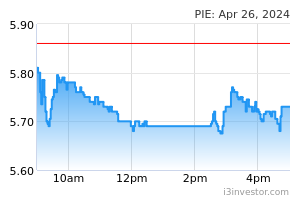

Is PIE selling at cheap price now?

1. Share price you pay now is more than Net Asset per share.

PIE's share price is RM 3.09, whilst its net assets is about RM 1.35.

2. Best performance in FY2021.

PIE's revenue & profit was all-time high in 2021, all-time high share price was in 2021 around RM4.10. PIE's revenue hit RM200m consecutively since quarter of 31 Dec 2020.

3. Financial Statements.

PIE's net cash generated from operations was positive most of the time, while remaining profitable since inception. PIE has given dividends consecutively for many years. Usually net cash, PIE recently had more borrowings than cash. (most probably to fund expansion)

4. Insider dealings.

6.12.2021-Mr. Law Tong Han bought 13k shares at RM3.75.

31.12.2021-Mr. Law Tong Han bought 8.7k shares at RM3.82, 1.3k shares at RM3.80.

6.1.2022-Mr. Law Tong Han bought 10k shares at RM3.70.

12.1.2022-Ms. Liao Yueh-Chen bought 10k shares at RM3.51.

19.1.2022-Mr. Law Tong Han bought 10k shares at RM3.00.

25.1.2022-Mr. Law Tong Han bought 10k shares at RM3.09.

21.3.2022-Mr. Loo Hooi Beng sold 5k shares at RM2.96.

9.6.2022-Mr. Law Tong Han sold 30k shares at RM3.30.

These mixed dealings do not show whether insiders think the company is undervalued.

5. PE ratio is around 20.

PIE's trailing PE ratio is neither high nor low, for an established company with strong track record.

I don't have shares in PIE. Averaging net profit to shareholders over the past 20 quarters, (10.8283mil/quarter) with PE ratio of 20, PIE should be worth RM 2.26. Looking forward to take a bite at my price. If share price never reaches my price, I will have to eat the humble pie.