- We initiate coverage on BP Plastics with a Hold. Our RM1.61 TP values the stock at CY24F P/E of 11.1x, or 1 s.d. above its 5-year average P/E.

- BP Plastics’ foresight to make sustainable thin-gauge cast stretch film since the early-2010s has elevated it to one of Asia’s biggest stretch film producers.

- The stock offers generous CY22-24F dividend yields of 4-5.4% – the highest in the plastic sector. This justifies the premium valuation, in our view.

One of Asia’s biggest stretch film producers is about to get bigger

For over 30 years, BP Plastics Holding has been making flexible plastic packaging films. Initially a producer of plastic bags, the company shifted its focus to expand into cast stretch films in 2000. This was followed by more investments in co-extrusion blown films in 2006. The shift earned it a 14.8% sales CAGR between FY00 and FY21, while FY00-21 core net profit rose at a 12.5% CAGR. By end-2022F, BP Plastics said its nameplate production capacity would rise from FY20’s 102,000 tonnes p.a. to 138,000 tonnes p.a.

Raising entry barriers with sustainable stretch film production

A strong point for BP Plastics, in our view, is its foresight to produce environmentally sustainable flexible stretch films. In early-2010s, the group started to use thinner-gauge stretch films to reduce raw materials – without compromising on its products’ strengths and durability. In our view, the financial and strategic benefits of pivoting to sustainable thinner stretch films were: i) allowing BP Plastics to raise its value and margins, and therefore avoid having to engage in a price war with smaller stretch film producers; and ii) effectively raising barriers to entry with the technological innovation and increasing its profile among customers that need to comply with ESG requirements.

Economic vagaries may slow down FY22-24F EPS growths

We project the spike in petrochemicals prices in 1H22 would pull down BP Plastics’ net profit from the record set in FY21. We expect its FY22F net profit would decline by 19.8% yoy despite a 14.5% yoy rise in turnover, as its margins would be affected by higher polyethylene (PE) prices. Although it is growing its capacity by end-FY22F, we expect its sales volume growth would be muted in FY23-24F due to the slowdown in the global economy. With that, FY23-24F EPS would rise by only 3.1-6.8% yoy, and its FY24F EPS would be 11.7% lower than FY21’s, in our view.

Initiate coverage with Hold and RM1.61 TP

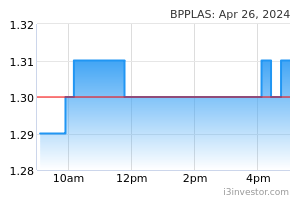

With the sales boom in FY21, BP Plastics’ share price jumped 60.4% yoy in 2021. In our view, the stock is already near its fair valuation – which we set at CY24F P/E of 11.1x. This prompts us to recommend a Hold on BP Plastics as we initiate our coverage on the stock. Our target valuation is 1 s.d. above its CY17-Aug 2022 mean P/E of 8x to put a value to its CY22-23F dividend yields of 4-5.4%, which is higher than the sector’s weighted average of 2.5-3%. Upside risks include a spike in sales volume, sustained high selling prices, and higher dividends. Downside risk: sales falling yoy in FY23-24F.

Source: CGS-CIMB Research - 15 Sep 2022