KUALA LUMPUR (March 23): Yinson Holdings Bhd's net profit jumped 158.5% for the fourth quarter ended Jan 31, 2023 (4QFY2023) amid higher contribution from engineering, procurement, construction, installation and commissioning business activities.

The floating production storage offloading (FPSO) vessels operator reported a net profit of RM168 million or 4.6 sen per share for the quarter, compared with RM65 million or 1.3 sen per share a year earlier.

Quarterly revenue also rose sharply to RM1.96 billion, from RM741 million in 4QFY2022, said Yinson in a stock exchange filing.

For the full year, net profit rose 46% to RM586 million from RM401 million in FY2022, while revenue grew 75% to RM6.32 billion from RM3.61 billion.

The group declared a dividend of one sen per share, bringing total dividend payout for the year to two sen, compared with six sen in FY2022.

Going forward, Yinson said although demand for alternative energy sources such as renewables have surged, the outlook for oil and natural gas remains significantly strong over the longer term.

“The increase in global energy demand has encouraged the increase in global upstream capex spending as the world economy continues to recover despite impacts of inflation and supply chain disruptions,” it said.

Yinson said the demand for FPSOs is positive with the increase in project sanctions around the world particularly from Brazil, being the highest FPSO demand centre, followed by West Africa.

On the backdrop of ongoing geopolitical uncertainties and inflation globally, Yinson said it is well-positioned to face the uncertainties with robust risk and internal control management in place and the implementation of robust cost control management.

“We will continue to apply measures to prudently manage inflation and interest rate risks including hedging, effective forecasting, diversification of costs across geographical markets, factoring inflation risk into our contracts and strategic management of our inventories.

“As an energy infrastructure and technology provider with a solid leadership position in sustainability, the management is confident of the group’s ability to stay resilient amidst the rising global economic challenges with its underlying risks,” the group said.

Supported by the group’s existing portfolio of long-term contracts, Yinson believes it can achieve “satisfactory” results for FY2024.

Yinson executive chairman Lim Han Weng said in a statement that the group’s FPSO division currently has a total orderbook of over US$22 billion (RM97.3 billion), including the FPSO Agogo project for Azule Energy.

On the group’s renewable businesses, Lim said Yinson has over 3.3GW of early-stage projects under review globally, in addition to 1.1GW for which planning consents are in process and a further 770MW that are in early-stage constrction activities.

Total assets in operation are 177MW, he said.

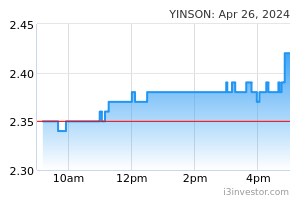

Shares of Yinson closed four sen or 1.7% higher at RM2.42, valuing the group at RM7.41 billion. The counter has fallen over 10% this month alone.

Source: TheEdge - 24 Mar 2023