KUALA LUMPUR (Feb 28): S P Setia Bhd’s net profit fell 26.7% to RM90.31 million for the fourth quarter ended Dec 31, 2022 (4QFY2022), from RM123.31 million a year ago, mainly dragged by higher finance costs and tax.

S P Setia’s finance costs had swollen to RM82.35 million in 4QFY2022, compared with RM42.9 million a year ago. Taxation also increased to RM91.19 million, up from RM62.14 million.

Revenue for the quarter, however, was up 65.4% to RM1.71 billion, from RM1.03 billion a year ago. This was driven by significant contributions from the property segment, particularly the handover of Australia's UNO Melbourne (Phase 1), which generated a revenue of RM106.2 million, and Sapphire by the Gardens, which contributed RM788.5 million.

For the full year, S P Setia reported a net profit of RM308.09 million, an increase of 8.3% from RM284.36 million for FY2021, the property developer said in a filing with Bursa Malaysia on Tuesday (Feb 28).

Meanwhile, revenue stood at RM4.45 billion, compared with RM3.76 billion for FY2021.

Local projects contributed RM3.58 billion or approximately 87% of sales, while international projects contributed RM525 million or about 13% of sales.

On the local front, the sales secured were mainly from the central region of Peninsular Malaysia with RM2.54 billion. The southern region contributed RM615 million, while the northern and eastern regions contributed RM322 million.

As for international projects, Battersea Power Station outperformed with sales of RM424 million, while Australia contributed another RM43 million.

“The total sales secured were partly complemented by the concerted effort of clearing completed inventories amounting to RM622 million in sales value. As of Dec 31, 2022, the group had secured additional sales in the pipeline of RM385 million," S P Setia president and chief executive officer Datuk Choong Kai Wai said in a separate statement.

S P Setia has set a sales target of RM4.2 billion for FY2023, representing a growth of 5% from the preceding year.

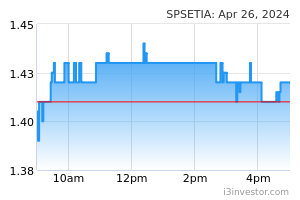

Shares in S P Setia were unchanged at 62 sen on Tuesday, giving the group a market capitalisation of RM2.53 billion.

Source: TheEdge - 1 Mar 2023