KUALA LUMPUR (Feb 27): Amway Malaysia Bhd’s shareholders can look forward to dividends of 23 sen per share, after the multi-level marketing (MLM) company’s net profit surged to RM22.98 million in the fourth quarter ended Dec 31, 2022 (4QFY2022).

The company's quarterly profit was nearly 27 times more than the RM852,000 reported a year ago. Notably, the latest quarterly net profit is the highest recorded since the first quarter ended March 31, 2015 (1QFY2015), when it recorded a net profit of RM36.74 million that time.

Amway declared a fourth single-tier interim dividend of five sen per share plus a special single-tier interim dividend of 18 sen per share, payable on March 29, 2023.

Amway attributed the strong net profit to price increases, normalisation of Amway Business Owner (ABO) incentives and ABO incentive trip cancellation.

As a result, its earnings per share ballooned to 23 sen in 4QFY2022 from nine sen previously.

Quarterly revenue rose marginally by 1.2% to RM397.14 million, from RM392.41 million a year before, mainly driven by new launches as well as stronger sales from personal care products, along with its pre-price increase buy-up.

The strong quarterly performance lifted Amway’s annual net profit to RM76.88 million for the financial year ended Dec 31, 2022 (FY2022), more than double from the RM36.78 million posted in FY2021. Annual revenue inched up 1.94% to RM1.51 billion from RM1.49 billion.

Commenting on FY2022’s result, Amway said the group has delivered modest revenue growth on the back of solid initiatives and fundamentals established in 2021 and 2022.

Going forward, it noted that the ongoing global supply chain disruption and rising inflation coupled with geopolitical crises will continue to put pressure on global economic growth.

“Despite these economic headwinds, the group is cautiously optimistic of continuing to deliver modest revenue growth for 2023,” it added.

However, Amway warned that the rising cost of purchase due to inflation and non-recurring cost savings in FY2022 will exert pressure on the operating margins for 2023.

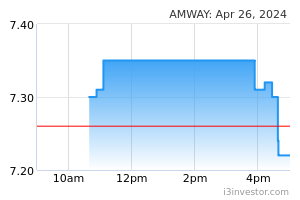

Amway’s share price closed one sen or 0.18% lower at RM5.40, bringing the group a market capitalisation of RM888 million.

Source: TheEdge - 28 Feb 2023