KUALA LUMPUR (Feb 21): Sports Toto Bhd’s net profit grew 21.77% to RM64.86 million in the second quarter ended Dec 31, 2022 (2QFY2023) from RM53.26 million in the same period last year, primarily due to improved results by its principal subsidiary company STM Lottery Sdn Bhd.

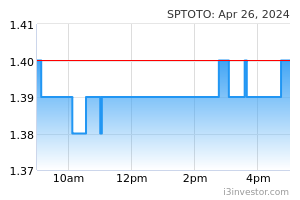

The group's quarterly revenue rose 13.07% to RM1.41 billion from RM1.25 billion. It declared a second interim dividend of 2.5 sen per share amounting to RM33.74 million, to be paid on April 21.

"The improvement in result was mainly due to the improved performance of STM Lottery, which reported an increase in revenue of 28.4% and pre-tax profit of 29.6% in the current quarter under review," said the number forecast operator (NFO) in a filing on Tuesday (Feb 21).

STM Lottery’s earnings growth was driven by strong sales of the 4D Jackpot game and a higher number of draws, as 48 draws were conducted in 2QFY2023 compared to 45 draws in 2QFY2022.

H.R. Owen plc, meanwhile, incurred a pre-tax loss of RM800,000 in the quarter under review as opposed to pre-tax profit of RM14.9 million in 2QFY2022 amid higher operating costs due to inflationary pressure as well as UK interest rate hike impact on the higher stocking loan drawdown.

“H.R. Owen posted a slight increase in revenue of 1.7% in the quarter [under review] as opposed to the previous year’s corresponding quarter. However, the unfavourable foreign exchange effect dragged the revenue down by 2.7% when converted to ringgit, being the reporting currency of the group,” said Sports Toto.

For the first half period (1HFY2023), Sports Toto’s net profit jumped nearly four times to RM136.35 million from RM35.59 million in 1HFY2022 as revenue climbed 38.39% to RM2.83 billion from RM2.04 billion.

Looking ahead, Sports Toto said the NFO industry in Malaysia continues to be vigilant amid the new political landscape and to carefully navigate through the changes in the local government policies.

Additionally, it said, the management is cautiously optimistic that the recovery in consumer spending, influx of tourism-related activities and rebound in export trade will continue to support the economic growth.

“The group will remain vigilant and continue to monitor the resultant financial impact to operations from the global and local political and economic development, particularly in the countries that the group has operations in,” Sports Toto commented on its prospects.

“The directors cautiously anticipate that the group’s businesses will remain encouraging and steadfast, particularly with the resilient nature of NFO business as noted in the past economic crises and turbulent periods.

“Barring any unforeseen circumstances, the directors are confident that it will continue its lead in terms of market share in the NFO business for the financial year ending June 30, 2023,” it added.

Sports Toto’s share price, which has fallen 22% over the past year, closed at RM1.50 on Tuesday, with some 986,800 shares changing hands. At its closing, the group had a market capitalisation of RM2.03 billion.

Source: TheEdge - 22 Feb 2023