KUALA LUMPUR (Feb 13): Moody’s Investors Service has revised the outlook of Genting Bhd (Genting) from ‘negative’ to stable’, as its credit metrics are expected to improve over the next 12 to 18 months, supported by a continued recovery in its operating performance.

The rating agency has also made similar revisions to the outlook of Genting's wholly owned subsidiaries Genting Overseas Holdings Ltd (GOHL) and Genting Singapore Ltd (GENS).

In a note on Monday (Feb 13), the rating agency said it has affirmed the Baa2 issuer ratings of Genting and GOHL, as well as the A3 issuer rating of GENS.

However, it sees potential downward pressure on ratings should Genting’s expansion plan see a material increase in debt which could in turn derail expectations of deleveraging.

The rating agency downgraded Genting’s issuer rating in May 2020, as the gaming and hospitality sectors emerged among the worst-hit sectors due to the Covid-19 pandemic.

On the revision, Moody’s analyst Yu Sheng Tay expects Genting will maintain excellent liquidity on a standalone basis, supported by dividend cash flows from its operating subsidiaries and a well-managed debt maturity profile.

Tay said Genting’s consolidated earnings before interest, taxes and depreciation (Ebitda) is forecasted to increase to around RM8.9 billion in 2023 from RM7 billion for the 12 months ended Sept 30, 2022.

This is boosted by ongoing recovery in the group’s leisure and hospitality businesses, particularly in Malaysia and Singapore, where pandemic and border restrictions eased last year.

“For Genting, it will also benefit from a full-year earnings contribution from Resorts World Las Vegas," said Tay. Genting has diversified gaming operations across six countries and holds duopoly and monopoly market positions in Singapore and Malaysia, respectively.

“Consequently, Genting’s leverage, as measured by debt-to-Ebitda, will improve to around 4.5 times in 2023 and around 4.0 times in 2024, from 6.1 times in the 12 months ended Sept 30, 2022.

"The company's retained cash flow-to-net debt will also improve to around 20% in 2023 and 2024, from 13%,” Tay said.

However, Genting’s leverage could fail to trend towards four times if the group wins a casino licence in New York because of upfront licence fees and development costs, which could exceed US$1 billion (RM4.36 billion).

"The group's plans to expand its New York gaming operations under Genting Malaysia Bhd may affect its credit quality, but such developments, including the timing and funding structure of the investment, ultimately hinge on the awarding of the casino licence, which remains uncertain at this point," Tay added.

“Although the outcome of the casino licence bid and funding structure for the associated cash outlay remain uncertain, a material increase in debt will derail Moody's expectation of deleveraging and indicates an aggressive financial policy, thereby exerting downward pressure on Genting's rating,” Tay explained.

Additionally, Moody's affirmed the Baa2 backed senior unsecured rating on the notes issued by GOHL Capital Ltd, a wholly owned subsidiary of GOHL. The notes are guaranteed by GOHL.

GOHL and GOHL Capital are supported by a keepwell deed between Genting, GOHL, GOHL Capital and the trustee of the guaranteed notes.

Genting remains on recovery path following the global economic reopening post-pandemic. As at end-September last year, Genting’s total borrowing stood at RM41.27 billion, up from RM32.13 billion at end-2019. Cash balance stood at RM22.39 billion, from RM30.28 billion at end-2019.

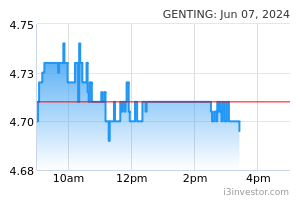

Genting’s share price settled three sen or 0.59% lower at RM5.08, valuing the group at RM19.69 billion. The counter has climbed 13.62% this year.

Source: TheEdge - 14 Feb 2023