KUALA LUMPUR (Feb 9): Kobay Technology Bhd’s net profit tumbled 37.8% to RM9.03 million in its second quarter ended December 31, 2022 (2QFY2023) against RM14.52 million in last year’s corresponding quarter (2QFY2022), due to the slowdown in the semiconductor market.

Similarly, quarterly revenue also decreased 11.5% to RM82.15 million from RM92.83 million previously, according to the group’s filing with Bursa Malaysia on Thursday (Feb 9).

Due to lower profit margin sales mix, weak market demand and high set-up cost for the new manufacturing plant, the manufacturing division’s profit before tax (PBT) fell 64% year-on-year to RM6.9 million.

However, PBT for the property development division jumped 163% to RM3.04 million, driven by an ongoing project in Langkawi.

Meanwhile, PBT for the pharmaceutical division was relatively stable at RM2.69 million.

For 1HFY2023, Kobay’s net profit decreased 19.4% to RM19.55 million from RM24.24 million the same period a year ago, with revenue improving 7.9% to RM171.59 million from RM158.97 million.

“Looking ahead, we anticipate the rest of FY2023 to remain challenging stemming from the elevated market uncertainties,” said Kobay’s managing director and CEO Datuk Seri Koay Hean Eng in a press statement.

“The slowdown in the semiconductor and electrical and electronic products industries have impacted our manufacturing business to a certain extent. Nevertheless, we expect the performance of this business to sustain in FY2023 while we expand our clientele exposure into renewable energy-related businesses.

“This, along with our plans to rationalise our manufacturing footprint and enhance our overall cost structure, will enable us to navigate through the headwinds,” he noted.

On the other hand, Kobay said it continues to gain positive momentum for the property development division. Its Langkawi project is expected to be completed by 3QFY2023 with a few more projects in the pipeline.

The group added that it will continue to adopt a prudent approach in its business operations and diversify its clientele base to incorporate various industries and businesses in order to mitigate and spread its risk in facing economic challenges.

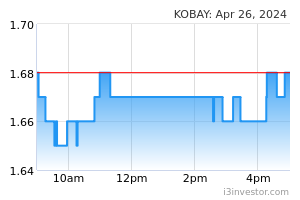

Kobay Technology’s share price closed unchanged at RM3.07 on Thursday with a market capitalisation of RM1 billion.

Source: TheEdge - 10 Feb 2023