KUALA LUMPUR (Feb 7): MNRB Holdings Bhd posted a net profit of RM71.23 million in the fourth quarter ended Dec 31, 2022 (4QFY22) compared to a net loss of RM22.1 million a year ago, driven by improved underwriting performance on top of higher investment income.

Quarterly revenue grew 10.6% to RM924.8 million compared with RM836.3 million in 4QFY21, mainly attributed to higher gross premiums generated by the reinsurance and takaful subsidiaries.

Earnings per share improved to 9.1 sen against loss per share of 2.8 sen a year ago, MNRB's filing with Bursa Malaysia on Tuesday showed.

The reinsurance group slipped into the red in 4QFY21 due to lower investment income and higher net claims and benefits incurred including claims arising from the December 2021 flood in Malaysia.

For the full year ended Dec 31, 2022 (FY22), MNRB's net profit jumped 13.7% to RM71.8 million compared with RM63.3 million posted in FY21, while its annual revenue came in higher at RM2.64 billion, an increase of 14.5% compared with RM2.3 billion in the previous year.

Its investment holding segment's revenue for the financial period was RM68.9 million compared with RM126.3 million reported in the same period last year.

The lower revenue was mainly due to a reduction in dividend income received from the subsidiaries as only RM23 million was received in the financial period compared with RM81 million received in the same period last year.

Revenue for the reinsurance business for FY22 increased by 13.4% to RM1.5 billion compared with RM1.3 billion in the same period last year, mainly driven by the increase in the general reinsurance business both from overseas and local portfolios by RM142.3 million and RM12.8 million respectively.

While retakaful business revenue for FY22 went up by 11.1% from RM52.8 million to RM58.6 million, mainly attributed to reinstatement contribution following the flood and fire losses.

Similarly, revenue for general takaful business increased by RM117.6 million or 31.8% from RM370 million to RM487.6 million from the corresponding period.

Significant increase in revenue was achieved due to the concerted effort to grow across all classes and channels of business.

Looking forward the group expects healthy premium/contribution growth contributed especially through our banca partnership supported by higher business volumes through managing general agents and overseas treaties.

“The takaful businesses continue to strengthen the business growth and profit by capturing a wider market share through incremental improvements to the quality of customer service, development of newer and more relevant products and investment in digitalisation.

“The reinsurance/retakaful segment is expected to expand despite a hardening market from the significant price rises and tighter terms and conditions,” said MNRB in the filing.

The group also anticipates volatility to reduce its investment return in the coming quarters, with a moderation in rate hikes in the US and locally as inflation numbers are improving.

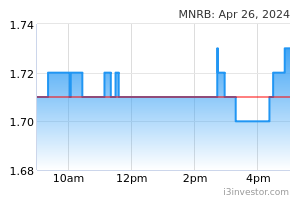

Shares of MNRB closed 0.54% or half sen lower at 92 sen giving the company a market value of RM716.52 million.

Source: TheEdge - 8 Feb 2023