KUALA LUMPUR (Jan 25): Analysts have called "hold" on Westports Holdings Bhd with target prices (TP) ranging from RM3.57 to RM3.90, after the group announced an improved fourth quarter earnings ended Dec 31, 2022 (4QFY2022) of RM235.04 million.

In several research notes on Wednesday (Jan 25), Hong Leong Investment Bank (HLIB) and CGS-CIMB have maintained a "hold" call on the port operator while MIDF Research has changed its recommendation to "neutral" from "buy" after revising its earnings forecast for the group.

MIDF's earnings revision was due to the Ministry of Finance’s 10-year investment tax allowance which lowers the effective tax rates between 20%-22%, while factoring in the imbalance cost-pass through implementation in first half of 2023 (1HFY2023) that is expected to impact electricity costs by 30%-40%.

The house has also taken into account the lower container throughput growth assumptions in the 2023 financial year end and 2024 financial year forecasts (FY2023/FY2024) to 2.1% and 4.1% respectively.

Nevertheless, it said the conventional throughput growth assumptions were expected to rise in FY2023/FY2024 to 2.0% and 2.0% respectively, from 1.0% on both years as the new Liquid Bulk Terminal 4A in 4QFY2023 was added to the assumptions.

“As such, our earnings estimates for FY2023E/FY2024F were revised marginally by +0.4%/-0.2%,” said MIDF, which has lowered its target price (TP) to RM3.90 from RM4.00.

Meanwhile, CGS-CIMB and HLIB shared the view that China’s border reopening may provide upside risks.

“Despite China being one of Malaysia’s largest trading partner, the China reopening is not expected to lead to a strong boost in TEU volumes as the decline in transhipment volumes were predominantly due to slowdown in purchases from the West, rather than borders closure in China,” said HLIB analyst Sophie Chuah Siu Li.

As such, Chuah raises HLIB’s FY2023/FY2024 earnings forecasts by 1%-4% after considering the group’s lower tax expenses and higher profit contributions from Port Klang Cruise Terminal offset by higher utilities and manpower costs. HLIB has increased its TP to RM3.78 from RM3.50.

Separately, CGS-CIMB analyst Raymond Yap said that its FY2023 forecast on earnings implies a minor growth of 1.7% for the year, offset by rising operating costs.

He added the downside risks include recessionary headwinds, rise in land lease charges and difficulties in future tariff hikes, but considers upside risks of China’s trade recovery and decreasing fuel price.

“China’s border reopening may stimulate a stronger-than-expected China trade recovery in 2H23F (second half forecast of 2023), and fuel prices may fall materially in a weak growth or recessionary environment,” said Yap. CGS-CIMB maintained its TP at RM3.57.

Westports Holdings reported its net profit of RM235.04 million in 4QFY2022 from RM222.88 million a year earlier (4QFY2021), an increase by 5.46% due to investment tax allowance. Its revenue has also improved by 3.42% to RM521.14 million against RM503.9 million a year earlier.

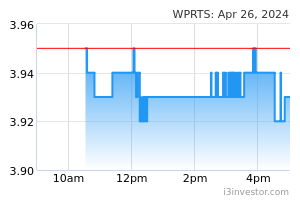

At the time of writing, Westports Holdings’ share price was up three sen or 0.80% to RM3.79, giving it a market capitalisation of RM12.92 billion.

Source: TheEdge - 26 Jan 2023