KUALA LUMPUR (Dec 20): UWC Bhd's net profit grew 27% in the first quarter ended Oct 31, 2022 (1QFY2023), thanks to the appreciation of the US dollar against the ringgit and an expansion in capacity to cater for the rising order book from the semiconductor industry.

The group is involved in the provision of precision sheet metal fabrication, value-added assembly services and precision machined components, mainly for the semiconductor, life science, medical technology and heavy-duty industries.

Net profit rose to RM29.25 million for 1QFY2023, from RM23.04 million a year ago, while revenue grew 22% to RM92.12 million from RM75.25 million.

UWC said its higher profit margins were attributable to encroachment into the front-end supply chain and provision of higher value products to its clients.

The group also has a net cash position of RM65.3 million with a current ratio of 5.98 times.

UWC’s executive director and group chief executive officer Datuk Ng Chai Eng said the improved financial performance is backed by strong demand from clients in the semiconductor sector.

“With all the expansion plans we had, we are well poised to seize any opportunity which may arise from that field,” he said.

“Moving forward, our optimism of the global semiconductor industry’s outlook remains steadfast. The ongoing global economic and geopolitical developments may have initiated a snowballing effect where the global industry’s growth projection was trimmed.

“While growth may have been downgraded, the global market is still valued at over RM2.5 trillion in (calendar year) 2023. Huge opportunity to chip away part of the market to boost our market share,” he added.

UWC said order books remain strong with the addition of front-end semiconductor, life science and 5G test equipment.

“The group continues to grow existing partnerships, secure new projects and onboard new customers,” it said.

UWC also updated that it has commenced mass production for 5G millimetre-wave testers while the progress of vehicle-to-vehicle testers production set-up remains on track.

“In addition, the group is exploring to manufacture autonomous vehicle-related chip testers, and currently finalising the projects on electric vehicles battery cell emulators. The group also ventures into the front-end semiconductor manufacturing business and has already secured qualification for several components. More front-end manufacturing related projects are in the pipeline,” it said.

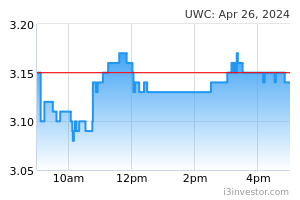

Shares of UWC eased six sen or 1.4% to RM4.19 at market close, giving the group a market capitalisation of RM4.61 billion.

Source: TheEdge - 20 Dec 2022