KUALA LUMPUR (Dec 8): Cash-strapped Sapura Energy Bhd returned to the black for the third quarter ended Oct 31, 2022 (3QFY2023), with RM10.18 million net profit versus a huge RM669.34 million net loss in the previous year’s corresponding quarter.

The improvement is due to lower recognition of provision for foreseeable losses, lower project costs recognised, lower depreciation, higher share of profit from associates and joint ventures, and a favourable foreign exchange gain during the quarter.

In contrast, quarterly revenue fell 12.42% to RM1.28 billion from RM1.46 billion in 3QFY2023, amid lower revenue recognised from the engineering and construction (E&C) business segment from a lower percentage of completion of executed projects.

The oil and gas services provider’s filing on Thursday (Dec 8) showed that it posted a 0.06 sen earnings per share for the quarter, against a loss-per-share of 4.19 sen in the prior year.

Thanks to improved 3Q net profit, the group posted a cumulative net profit of RM99.53 million in the nine months ended Sept 30 (9MFY2023), compared with a massive RM2.28 billion cumulative net loss a year earlier.

However, nine-month cumulative revenue declined 9.24% from RM3.67 billion, to RM3.33 billion

Compared to the immediate preceding quarter, Sapura Energy also returned to profitability after recording a net loss of RM2.59 million in 2QFY2023, while revenue increased 8.72% from RM1.17 billion, due to higher utilisation days in the drilling segment.

Moving forward, as part of its efforts to improve overall cashflow, the group said it is has committed to continuing its review of underperforming contracts, as well as renegotiating commercial settlements with customers.

Sapura Energy faces challenges in rebuilding its order book, given the limited access to bank guarantees and working capital facilities during its restructuring phase, particularly impacting the E&C and operations and maintenance (O&M) business segments.

“Its drilling arm, however, recorded a strong growth with 10 out of the 11 rigs fully operational at the end of 3QFY2023. The group’s order book currently stands at approximately RM6.8 billion.

“Separately, the non-consolidated order book of the group’s joint venture entities is approximately RM5.7 billion,” it said in a separate statement.

In line with its aim of portfolio rationalisation, Sapura Energy recently completed the disposal of three drilling rigs to NKD Maritime Ltd.

Following the Corporate Debt Restructuring Committee of Malaysia (CDRC)’s agreement to assist Sapura Energy in mediating its debt restructuring with lenders, the group submitted a draft Proposed Restructuring Scheme (PRS) to the CDRC on Sept 29, 2022.

“It has since been participating in CDRC-mediated meetings with financial institutions to seek feedback on and to refine the terms of the PRS. This draft restructuring proposal will form part of the group’s overall restructuring and regularisation plan, which upon finalisation, will be submitted to Bursa Malaysia.

“Additionally, the group is nearing the end of its Proof of Debt exercise with its trade creditors,” Sapura Energy added.

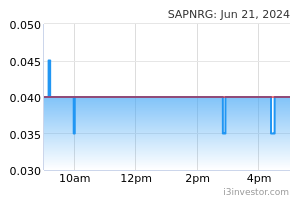

Shares of Sapura Energy jumped 14.29% or half a sen to close at four sen on Thursday, valuing the group at RM639.16 million. It’s share price has fallen 20% year-to-date.

Source: TheEdge - 9 Dec 2022