KUALA LUMPUR (Dec 8): Local oil and gas (O&G) players are expected to benefit from the rise in domestic capital expenditure (capex) by Petroliam Nasional Bhd (Petronas), said analysts.

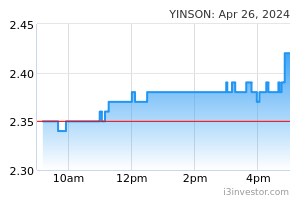

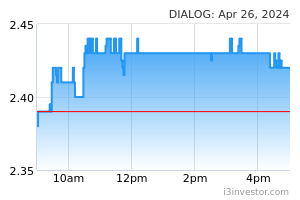

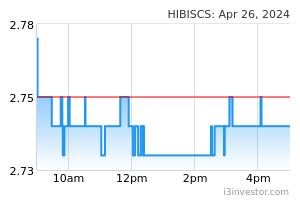

Maybank IB Research, citing a 34% year-on-year (y-o-y) increase in Petronas' domestic capex, said its top picks in the sector include Yinson Holdings Bhd, Dialog Group Bhd and Hibiscus Petroleum Bhd.

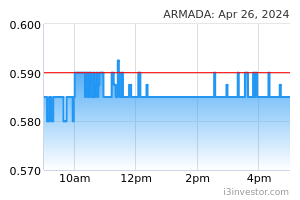

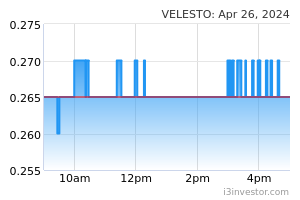

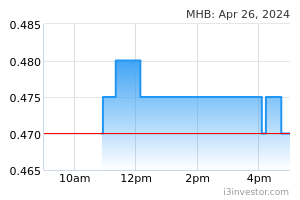

"Meanwhile Bumi Armada Bhd, Velesto Energy Bhd, Wah Seong Corp Bhd and Malaysian Marine & Heavy Engineering [Holdings Bhd] are our small and mid caps 'buy'," it said.

It said Petronas is on track to meet its RM100 billion earnings target for FY2022 after the national oil company posted strong nine-month financial results with core net profit of RM72 billion, up 173% y-o-y.

“We expect oil price to remain elevated, as the winter period approaches and geopolitical risk remains high,” it said, adding that crude oil average estimate for FY2022 is unchanged, at US$100 per barrel (Brent).

“We do not rule out a higher oil price outlook in FY2023 considering the continued tightness in the global supply market, due to the prolonged structural under-investment since 2015,” it added.

Maybank also noted Petronas’ efforts in carbon emissions abatement and scaling up investment allocation on carbon neutral projects.

“With its NZCE 2050 pathway announced on Nov 1, 2022, Petronas has set a near-term target to cap operational emission to 49.5 million tonnes of CO2e by 2024 in Malaysia and achieve 25% absolute emissions reduction groupwide by 2030 (based on 2019’s baseline),” it said.

It said for this, Petronas will allocate 20% of its capex for decarbonisation projects and expansion into cleaner energy solutions over the next five years (2023 to 2026). Petronas targets 50% improvement in cashflows from operations by 2025 and 30% growth in revenue from new non-traditional business by 2030.

External headwinds remain

The Bursa Energy Index continues to track the falling crude oil prices, which fell to almost a year low of US$77.69 per barrel on Thursday (Dec 8) morning.

At 11am, the index was down 12 points at 775.81, with more losers (12) than gainers (five).

Leaders include Wah Seong Corporation Bhd (up 5.7% at 64.5 sen), Reach Energy Bhd (up 10% at 5.5 sen) and Icon Offshore Bhd (up 3% at 15.5 sen). Among the laggards were Dayang Enterprise Holdings Bhd (down at 3% at RM1.30), Hibiscus Petroleum (down 3.17% at RM1.02) and Petron Malaysia Refining & Marketing Bhd (down 0.94% at RM4.22).

Investors are assessing the implications from the price cap imposed on Russian crude, and China’s relaxation on Covid measures on crude oil prices.

Meanwhile, International Energy Agency (IEA) in a recent statement said the energy security concerns caused by Russia’s invasion of Ukraine have motivated countries to increasingly turn to renewables such as solar and wind to reduce reliance on imported fossil fuels, whose prices have spiked dramatically.

Global renewable power capacity is now expected to grow by 2,400 gigawatts (GW) over the 2022-2027 period, an amount equal to the entire power capacity of China today, according to Renewables 2022, the latest edition of the IEA’s annual report on the sector.

Source: TheEdge - 9 Dec 2022