KUALA LUMPUR (Nov 21): LBS Bina Group Bhd’s net profit for the third quarter ended Sept 30, 2022 (3QFY22) jumped 94.93% RM35.35 million from RM18.14 million in the same period last year, driven by solid revenue growth from its property development segment.

Earnings per share was up at 1.78 sen from 0.88 sen previously, the construction and property development outfit’s bourse filing on Monday (Nov 21) showed.

Quarterly revenue more than doubled to RM528.89 million, from RM253.96 million in the same period a year ago.

For the first nine months, LBS Bina’s net profit increased 68.95% to RM100.64 million from RM59.57 million, as cumulative nine months of revenue grew 46.12% to RM1.35 billion from RM922.43 million.

As of Nov 20, the group had secured RM1.83 billion worth of property sales, which accounts for 114% of the its financial year 2022 sales target of RM1.6 billion.

“This achievement is remarkable despite the challenging operating conditions beset by inflationary pressure, labour shortages, high material costs and rising interest rates,” it said.

With Klang Valley being the largest sales contributor at 89%, LBS Bina noted that the bulk of new sales during the ten months were contributed by projects at LBS Alam Perdana, KITA @ Cybersouth and Idaman BSP.

It said homeowners of LBS Alam Perdana, the main sales contributor, will benefit from the opening of DASH Highway, and this has shortened the travel distance from Puncak Alam to Kota Damansara/One Utama, Petaling Jaya significantly.

“We believe the ongoing full stamp duty exemption on first residential homes below RM500,000 will continue to boost homeownership among middle-income earners, as 60% of our properties are priced within the RM500,000 range,” added LBS Bina.

Looking ahead, LBS Bina expects the momentum to continue with RM424 million worth of launches in 4Q22, including the 26-unit Emerald Garden in Batu Pahat, and the 1,448-unit Idaman Melur in Sepang.

While the current industry challenges are expected to persist, at least in the near term, the group said its healthy unbilled sales of RM2.54 billion continue to provide revenue visibility for the next two- to three years.

The group said it would continue to advance digitalisation within the organisation, step up departmental centralisation, and continue automated data gathering on industrialised building systems (IBS) for greater output and quality.

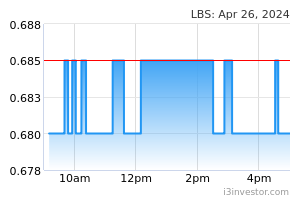

LBS Bina’s share price ended on Monday (Nov 21) 1.22% or half a sen lower at 40.5 sen, bringing the group a market capitalisation of RM635.5 million.

Source: TheEdge - 22 Nov 2022