KUALA LUMPUR (Nov 9): Brewery counters were among the top gainers on Bursa Malaysia on Wednesday (Nov 9) after Heineken Malaysia Bhd’s strong third-quarter corporate earnings raised investors’ spirits on prospects ahead for breweries.

On Tuesday (Nov 8), Heineken saw its net profit double to RM108.74 million for the third quarter ended Sept 30, 2022 (3QFY22) from RM51.02 million a year earlier, mainly due to strong post-Covid-19 pandemic recovery following the reopening of international borders in April, increased on-trade consumption, as well as positive mix impact from the group’s premium portfolio growth.

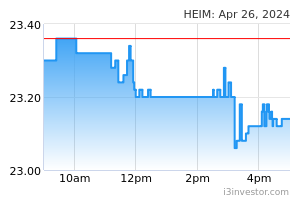

Heineken’s share price climbed as high as RM1.76 or 7.51% to reach its intraday high of RM25.20 in the morning session, making it the day’s second top gainer on the local bourse. It pared some gains to end the day at RM24.66, still up RM1.22 or 5.2% from Monday’s (Nov 7) closing, bringing it a market capitalisation of RM7.49 billion. A total of 819,000 shares were traded, more than four times the counter’s 200-day average trading volume of 189,880.

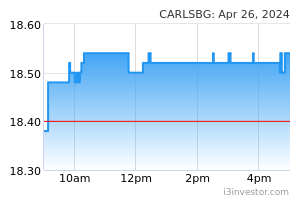

Carlsberg Brewery Malaysia Bhd was the third top gainer of the day, surging as much as 94 sen or 4.25% to its intraday high of RM23.06 before it pared some gains to close at RM22.62. At RM22.62, Carlsberg has a market value of RM6.92 billion.

RHB Research analyst Soong Wei Siang said in a note on Wednesday that Heineken’s 9MFY22 results beat his expectations on a stronger-than-expected sales recovery.

Given the strong results, Soong raised his FY22 to FY24 earnings estimates by 6% to 10%. He is anticipating Heineken to report annual net profit of RM381 million for FY22, further growing to RM418 million for FY23 and RM434 million for FY24.

Soong also raised his target price for Heineken to RM30.50, from RM29.20 previously, maintaining a “buy” call for the stock.

“We view the current valuation (trading below its five-year mean) as unwarranted considering the robust consumption on the back of contained contrabands and pricing power to pass on higher costs without deterring its volume, thanks to the relatively inelastic demand for beer.

“We continue to like the stock for its market leadership and attractive dividend yield of 5%-6%,” Soong said.

Similarly, Kenanga Research analyst Tan Jia Hui, who is maintaining a “market perform” call on Heineken, raised his target price to RM25.80, from RM25.60 previously, as Heineken’s 9MFY22 profit came in above the research outfit’s expectations on a major rebound in sales volume.

Tan also raised FY22 earnings forecast by 8.6% largely to reflect the increased sales volume.

Source: TheEdge - 10 Nov 2022