KUALA LUMPUR (Oct 31): Alam Maritim Resources Bhd said it is deemed a Practice Note 17 (PN17) issuer after its external auditor expressed a disclaimer of opinion in the group's audited accounts announced on Monday (Oct 31).

Baker Tilly Monteiro Heng PLT expressed the disclaimer of opinion in the audited financial statements for the financial period from Jan 1, 2021 to June 30, 2022, said Alam Maritim in a Bursa Malaysia filing.

The group said it is taking the necessary steps to address the PN17 status, and has worked on its proposed debt restructuring with creditor banks under the auspices of Bank Negara Malaysia's Corporate Debt Restructuring Committee (CDRC).

"A comprehensive regularisation plan is being progressed to address the PN17 status as set out in the proposed restructuring scheme that has been presented to creditor banks," it added.

On July 1 last year, Alam Maritim received approval from CDRC for its application for assistance to mediate between the group and its financiers and lenders.

Alam Maritim has been loss-making since the financial year 2016 (FY16) ended Dec 31, 2016. It made a profit after tax of RM45.81 million in FY15, before slipping into the red with a loss after tax of RM142.66 million in FY16.

It continued to incur losses over the subsequent years, with a loss after tax of RM145.38 million in FY17 that further widened to RM167.61 million in FY18.

Its loss after tax narrowed to RM80.28 million in FY19, before swelling to RM226.73 million in FY20 and RM209.61 million in FY22.

For the three months ended June 30, 2022, it posted a net loss of RM6.21 million on a back of a revenue of RM77.59 million. There are no year-on-year comparison figures due to the change in the group's financial year end, to June 30 from Dec 31.

In the immediate preceding quarter (January to March), the group reported a quarterly net loss of RM10.36 million and a revenue of RM56.82 million.

According to Alam Maritim, the change in financial year end is to allow more time to finalise its restructuring scheme. The change is also to facilitate better audit planning and allocation of resources.

For the cumulative 18-month period ended June 30, 2022, Alam Maritim booked a net loss of RM190.73 million on revenue of RM277.89 million.

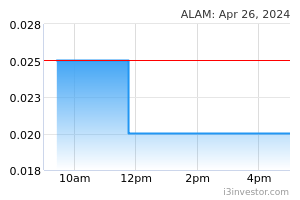

Alam Maritim's share price closed half a sen or 14.29% lower at three sen on Monday, giving the group a market capitalisation of RM46 million.

Source: TheEdge - 1 Nov 2022