KUALA LUMPUR (Oct 25): Independent adviser MainStreet Advisers Sdn Bhd has advised shareholders of Mulpha International Bhd to reject the unconditional voluntary takeover bid of the group by several joint offerors, deeming the offer price of RM2.30 per share as “not fair and not reasonable”.

In a circular note filed on Mulpha’s bourse filing on Tuesday (Oct 25), MainStreet Advisers said based on the revalued net asset value approach, the offer price per share represents a discount of RM14.92 or 86.64% of each Mulpha share.

Additionally, the independent adviser noted it is the intention of the joint offerors to maintain Mulpha’s listing status on Bursa’s Main Market, with the joint offerors also not intending to invoke the provisions of Subsection 222(1) of the CMSA.

“Based on the above and our evaluation, we are of the view that the offer is not fair and not reasonable. Accordingly, we advise the non-interested directors to recommend the [share]holders to reject the offer.

“Nonetheless, the decision to be made in respect to the offer would rest on the individual risk appetite and specific investment requirements of the [share]holders. [Share]holders should be mindful that there may be continuous fluctuations in the market prices of Mulpha shares,” said MainStreet Advisers.

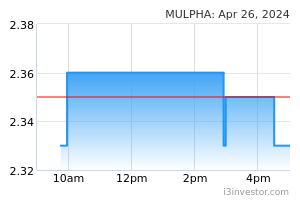

According to a stock exchange filing by Mulpha, the offer price of RM2.30 represents a 10.05% premium for the five-day volume weighted average market price (VWAP) of Mulpha shares up to Sept 22 of RM2.09 and a 9% premium for the one-month volume weighted average market price up of Mulpha shares to Sept 22 of RM2.11.

However, for the three-month VWAP of RM2.13, the offer price translates into a discount of 7.98%, while for the six-month VWAP of RM2.19, the offer price translates into a discount of 5.02%. Against the one-year VWAP of Mulpha shares up to Sept 22 of RM2.39, the offer price represents a discount of 3.77%.

Last month, Mulpha announced it had received an unconditional voluntary takeover offer from several joint offerors for the company’s shares not already held by them at RM2.30 a share.

The joint offerors — Lee Ming Tee, Lee Seng Hui, Lee Seng Huang, Klang Enterprise Sdn Bhd, Sagittarius Management Sdn Bhd, Mount Glory Investments Ltd, Magic Unicorn Ltd, Mountbatten Corp and Nautical Investments Ltd — intend to acquire the remaining 155.53 million shares or 49.98% of Mulpha’s total issued shares.

They currently hold 155.65 million or 50.02% of the 311.18 million issued shares. Based on back-of-the-envelope calculations, the offer price of RM2.30 a share values the offer at RM357.71 million.

Source: TheEdge - 26 Oct 2022