KUALA LUMPUR (Oct 20): Hextar Industries Bhd posted a net profit of RM3.09 million for the fourth quarter ended Aug 31, 2022 (4QFY22), a big leap from RM232,000 in the same quarter last year driven by higher average selling prices at fertilisers division and the recovery in heavy equipment and equipment rental divisions.

Earnings per share grew to 0.27 sen from 0.1 sen previously.

The group said its revenue for the quarter jumped 105% to RM61.4 million from RM29.96 million a year earlier.

For the full financial year 2022 ended Aug 31, 2022 (FY22), the group's net profit climbed several folds to RM8.86 million from RM1.64 million, as revenue more than doubled to RM257.82 million from RM123.04 million.

Despite the stellar earnings performance, the group did not declare dividends.

Hextar Industries managing director Benny Ang commented that geopolitical tensions resulting from the Russia-Ukraine war as well as sanctions and restrictions to export have led to the increase in the prices of fertilisers across the globe.

"Despite crude palm oil prices declining from the peak of RM8,000 per tonne recorded in the first half of 2022, food commodity prices and demand are still likely to increase in the long run due to its importance to livelihood and food security," Ang said in a statement on Thursday (Oct 20).

Additionally, he said, the recent proposed acquisition of Hextar Fertilizers Ltd Group represents a strategic initiative to enhance the group's competitiveness.

Upon the completion of the acquisition, Hextar Industries will have access to an immediate distribution network and manufacturing facilities within Peninsular Malaysia and East Malaysia, particularly Sabah.

The group is buying out Hextar Fertilizers from its controlling shareholder's private vehicle Hextar Holdings Sdn Bhd for RM480 million. The purchase consideration will be settled by issuing 1.6 billion new shares at 30 sen per share.

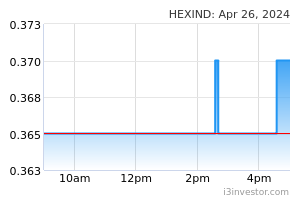

Hextar Industries' shares closed at 52 sen on Thursday (Oct 20), translating into a market capitalisation of RM590.99 million. The counter has shot up 225% year-to-date.

Ang explained that the group's annual capacity of compound fertilisers will also increase by approximately eight times from the existing 75,000 metric tonnes to 679,000 metric tonnes.

"Our strategy to expand the core fertiliser business beyond our current primary market in Sarawak together with the recovery of the Heavy Equipment and Equipment Rental divisions will enable us to grow significantly and we are very excited about the prospects for the HIB Group," he added.

Source: TheEdge - 21 Oct 2022