KUALA LUMPUR (Oct 12): Multi-level marketing (MLM) group Zhulian Corp Bhd recorded a net profit of RM7.65 million for the third quarter ended Aug 31, 2022 (3QFY22), down 20.06% from RM9.57 million in the same quarter last year, on lower revenue amid weak consumer sentiment, coupled with the impact of the Covid-19 pandemic and rising inflation.

Revenue in 3QFY22 fell 10.13% to RM32.96 million from RM36.67 million in 3QFY21, Zhulian’s bourse filing showed on Wednesday (Oct 12).

Nonetheless, the group declared a three sen dividend for its shareholders, with an ex-date of Nov 8, to be paid on Dec 7.

For the cumulative nine months ended Aug 31, Zhulian’s net profit grew 26.78% to RM41.47 million from RM32.71 million in the previous year. This was despite revenue falling 10.46% to RM103.92 million, from RM116.06 million.

“Results from operating activities stood at RM38.6 million, a significant increase of 33% from RM29.0 million recorded in [the] preceding year’s corresponding period. Increase was mainly due to disposal of leasehold land in Indonesia, resulting in a net gain of RM14.4 million after duly accounting for all relevant local statutory obligations.

“Share of profit of equity-accounted associate for the period under review was RM9.6 million, a decrease of 17% as compared to preceding year’s corresponding period of RM11.5 million,” said Zhulian.

The group’s business is closely linked to sentiments of the general consumer market and the fluctuating foreign currency exchange.

“Strengthening or weakening of Ringgit Malaysia against United States Dollar (USD) will have an impact on the group’s performance, as all export revenues are transacted in USD.

“The group ensures its business sustainability by adapting to the constant market demand change wherever possible, while it remains cautious on mounting inflationary pressures. The group is committed to continuously improve its business operational efficiency and maintain sufficient cash flows in the year 2022,” Zhulian added.

Zhulian principally manufactures jewellery and consumer products, thereafter selling them through a direct marketing network.

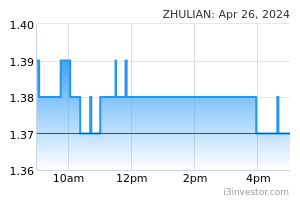

Zhulian’s share price closed unchanged at RM1.91 on Wednesday, with a market capitalisation of RM878.6 million.

Source: TheEdge - 13 Oct 2022