KUALA LUMPUR (Sept 20): Top Glove Corp Bhd closed the final quarter of its financial year ended Aug 31, 2022 (FY22) in the red, as escalating costs as well as normalisation in demand and average selling prices (ASPs) for gloves ate into its earnings.

For the fourth quarter ended Aug 31, 2022 (4QFY22), Top Glove posted a net loss of RM52.59 million compared to a net profit of RM447.4 million last year, according to the glove maker’s Bursa Malaysia filing on Tuesday (Sept 20).

As a result, the group logged a loss per share of 0.66 sen versus earnings per share of 5.59 sen in 4QFY21. Revenue for the quarter fell 52.28% to RM990.1 million from RM2.07 billion last year.

The 4QFY22 net loss caused its cumulative net profit for FY22 to plummet by 96.94% to just RM235.97 million from RM7.71 billion a year earlier. Full-year revenue also fell 65.94% to RM5.57 billion from RM16.36 billion in FY21.

In a statement, Top Glove said the dismal financial performance came as the glove industry weathers an adjustment period — where it contends with the twin factors of oversupply and excessive stockpiling by customers during the Covid-19 pandemic.

"This has led to a slowdown in orders, setting ASPs on a downward trend, which has been aggravated as customers adopt a ‘wait and see’ approach in anticipation of a further decline in ASPs," it said.

Following the decline in ASPs, the group has also written down its inventory value to net realisable value by RM56 million in 4QFY22 and by RM229 million for FY22.

Additionally, Top Glove said the group saw an escalation in cost structure attributed to global supply chain disruptions.

“On the domestic front, [the group] was impacted by approximately a 60% hike in natural gas tariff over the course of FY22, as well as a 25% increase in the Malaysian minimum wage from RM1,200 to RM1,500.

“The escalating costs, which the group is unable to pass on to customers amidst the ongoing oversupply situation, have impacted its bottom line,” it added.

Latest quarterly loss 'a temporary setback'

Commenting on the group’s financial results, Top Glove managing director Lim Cheong Guan said the oversupply situation and weaker demand for gloves which have distorted the sector’s supply and demand mechanism are temporary.

He added that the group’s 4QFY22 performance is not reflective of its business and sector’s true potential, noting that the loss position it finds itself in is a “temporary setback” and is confident that the industry will recover.

Top Glove said it has established mitigating measures which include deferring all capital expenditure for new capacity in 2023 in view of lower utilisation levels, in line with its primary focus of operational efficiency and cost rationalisation going forward.

“[The group] has also embarked on streamlining facilities, focusing on enhancing those producing its in-house supply of materials. In addition, Top Glove continues to collaborate with its suppliers towards ensuring more cost-effective procurement for a win-win outcome,” it added.

The group noted that coupled with this, it is planning to direct efforts to recapture sales to the US, promoting more cost-efficient products, while developing value-added products and enhancing its green product line.

Despite the oversupply situation, Top Glove said it remains confident that once customers’ stockpiles are depleted and glove restocking activity resumes, the market will stabilise and be better positioned to absorb the additional supply from new capacity.

“As the glove industry is estimated to be running at below 50% utilisation, glove supply is expected to reduce accordingly. The group anticipates that industry consolidation will follow, further reducing glove supply and paving the way for recovery.

“The challenging environment notwithstanding, Top Glove remains steadfast in its commitment to do well and deliver value to its stakeholders across the sustainability spectrum,” it added.

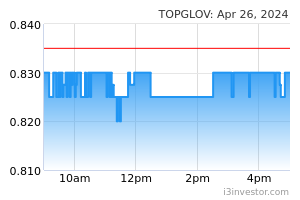

At noon break, Top Glove shares traded half a sen or 0.71% lower at 70 sen, giving the group a market capitalisation of RM5.71 billion. It saw 16.1 million shares changed hands, slotting it among the most active counters on the local bourse.

Source: TheEdge - 20 Sep 2022