KUALA LUMPUR (Aug 31): The public-listed subsidies of Petroliam Nasional Bhd (Petronas) maintained their dividend payments, if not higher, in the first half of the financial year 2022 (1HFY22).

The five subsidiaries — Petronas Chemicals Group Bhd (PetChem), Petronas Gas Bhd (PetGas), Petronas Dagangan Bhd (PetDag), MISC Bhd and KLCCP Stapled Group Bhd — collectively declared total dividends of RM3.7 billion in 1HFY22.

Petronas received a total of RM2.22 billion from these five subsidiaries in 1HFY22.

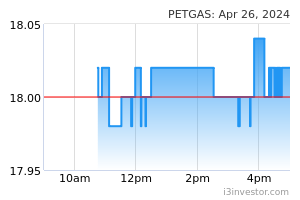

Among the five, PetGas declared the highest dividend per share at 32 sen. However, PetChem's, which has the biggest cash pile among all Bursa-listed companies, total payout was the highest at RM2 billion for the January-June period.

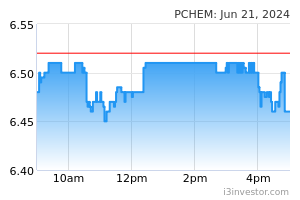

PetChem, a 64.35%-owned unit of Petronas, announced an interim dividend of 25 sen per share for 1HFY22. This is higher than the 23 sen dividend, or RM1.84 billion, paid in the previous corresponding six months.

PetChem's cumulative net profit grew nearly 19% to RM3.95 billion in 1HFY22 from RM3.32 billion in 1HFY21 as revenue increased 28.5% to RM13.22 billion from RM10.28 billion due to higher product prices.

PetGas kept its dividend per share at 32 sen or RM633.2 million in 1HFY22, the same as in 1HFY21, although the group's net profit fell 15.5% to RM807.08 million from RM955.47 million a year ago. Its cumulative revenue, however, went up 8.8% to RM2.96 billion from RM2.72 billion.

PetGas attributed its lower net profit to unfavourable foreign exchange movements and higher effective tax rate from the imposition of the prosperity tax, while its utilities segment contributed higher revenue.

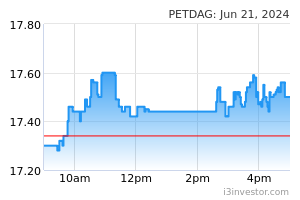

PetDag, Petronas' retail arm, declared a dividend of 15 sen per share or RM158.95 million, one sen higher than the 14 sen or RM139.08 million declared in 1HFY21.

PetDag posted a 30.35% increase in cumulative net profit to RM356.17 million from RM273.25 million, while cumulative revenue expanded 65.8% to RM17.12 billion from RM10.32 billion, mainly due to higher gross profit in the retail segment, which was accompanied by an increase in sales volume.

PetDag, which runs the largest network of petrol stations nationwide, saw its receivables almost triple to RM10.3 billion from RM3.49 billion as at Dec 31, 2021. The amount was barely RM1.29 billion a year ago.

PetDag, in which Petronas controls a 63.92% stake, warned in its quarterly result release that the prolonged impact of "the outstanding subsidy receivable will however pose a challenge to the group's profitability and liquidity position".

"Nevertheless, we are working towards resolving the situation in due course. The group will diligently monitor and implement measures to minimise any adverse impact from this situation," it said.

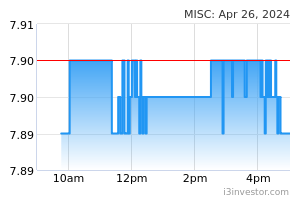

Petronas' shipping arm, MISC Bhd, posted a cumulative net profit of RM357.3 million, down 63.1% from RM968.6 million recorded for 1HFY21, while cumulative sales rose 24.2% to RM6.08 billion from RM4.89 billion. For 1HFY22, the group's total dividend was unchanged at 14 sen or RM625 million, same as in 1HFY21. Petronas controls a 51% stake in MISC.

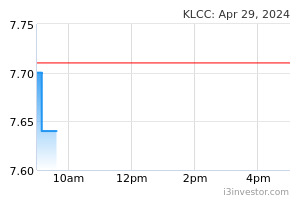

Petronas' real estate investment trust, KLCCP Stapled Group, that owns the Petronas Twin Towers also paid a higher dividend of 16 sen or RM288.86 million in 1HFY22, up from 14 sen or RM252.74 million in the same period last year.

KLCCP Stapled Group's cumulative revenue rose 12.6% to RM326.6 million from RM290.14 million, while revenue increased 19.5% to RM672.02 million from RM562.54 million, mainly due to better performance by the retail segment, driven by lower rental support and higher advertising revenue.

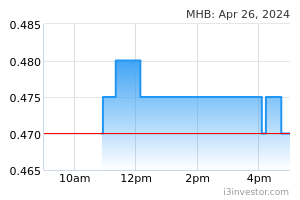

Petronas' related company, Malaysia Marine and Heavy Engineering Holdings Bhd, is the only one that did not declare any dividend. The fabrication yard operator last paid a dividend of three sen per share amounting to RM48 million in 2017.

Source: TheEdge - 31 Aug 2022