KUALA LUMPUR (Aug 3): Fraser & Neave Holdings Bhd (F&N) reported a marginal increase in its net profit of RM97.5 million in the third quarter ended June 30, 2022 (3QFY22), compared with RM96.16 million a year ago.

Earnings per share increased to 26.60 sen from 26.20 sen a year earlier, the food and beverage group’s filing with Bursa Malaysia on Wednesday (Aug 3) showed.

Quarterly revenue rose 5.53% to RM1.12 billion from RM1.06 billion due to the positive momentum from recovery of economic activities and strong festive sales in Malaysia, as well as price adjustments.

F&N’s profit before tax, meanwhile declined by 4% to RM114.4 million in 3QFY22 from RM119.2 million in 3QFY21, due to commodity price pressures, stronger US dollar and foreign exchange translation loss from a weaker Thai baht.

For the nine months ended June 30, F&N’s net profit fell 15.5% to RM284.32 million from RM336.47 million, on higher commodity prices, flood impact, and foreign exchange translation loss from a weaker Thai baht. “The rise in global commodity prices amounted to an additional RM300 million cost of goods sold impact for the nine months,” it said.

In contrast, the group’s nine-month revenue inched up 3.03% to RM3.33 billion, from RM3.23 billion.

On prospects, F&N said headwinds such as ongoing supply chain disruptions, raw material shortages, high input prices and geopolitical uncertainty will continue to put pressure on the group’s margin until the last quarter of the financial year.

Additionally, it said rising inflation, and ringgit and Thai baht depreciation against the US dollar will add further cost pressures, although the impact will be mitigated partially by export receipts in US dollar.

Nonetheless, F&N is confident that the reopened borders in Malaysia and Thailand will spur tourist arrivals, consumer spending and economic activity.

“Moving forward, we will intensify efforts on upholding our leadership positions in the market and executing the upcoming initiatives that will enable us to boldly take strategic steps toward new product offerings, integrated farming and potential partnership development,” said F&N.

“We are looking forward towards the completion of our ASRS Warehouse in Shah Alam (pending full repairs and replacement of parts affected by the flood), drinking water production plant at KKIP (Kota Kinabalu Industrial Park), new liquid milk & plant-based beverages factory in Thailand, and plant-based beverages capability at our Pulau Indah plant by the end of 2022.

“The group’s latest proposed acquisition of Ladang Permai Damai Sdn Bhd and proposed privatisation of Cocoaland Holdings Bhd will drive our future growth prospects and will bring us closer to our ambition to be a stable and sustainable food and beverage leader in ASEAN,” F&N added.

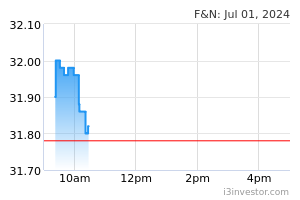

F&N’s shares closed down eight sen or 0.36% at RM21.94 on Wednesday, giving the group a market capitalisation of RM8.05 billion. It is currently trading at a historical price-to-earnings ratio of 23.59 times, offering a dividend yield of 2.73%.

The stock has fallen 11.17% year-to-date from RM24.70.

Source: TheEdge - 4 Aug 2022