KUALA LUMPUR (June 15): Eco World International Bhd (EWI) posted a net loss of RM67.35 million for the second quarter ended April 30, 2022 (2QFY22) against a net profit of RM11.3 million a year ago as revenue plunged 70%.

In a bourse filing on Wednesday (June 15), the property developer said the net loss was in line with its revenue for the quarter falling 69.26% to RM33.08 million from RM107.56 million, owing to fewer units sold being handed over to customers as well as its share of losses in joint ventures (JVs).

The developer said there had been a revision of profit margins on EW-Ballymore projects and higher inventory holding costs as a result of a longer period of time taken for sales realisation. EW-Ballymore is its maiden JV in the United Kindom.

"Following the above revision of project profit margins and longer period of time expected to realise the sale proceeds, an impairment on investment in EW-Ballymore amounting to RM36.16 million was recognised," it added.

On a quarter-on-quarter basis, EWI's net loss widened from RM14.66 million in 1QFY22, as revenue dropped 32.83% from RM49.24 million.

In a statement, EWI said it is on track to achieve its RM2 billion sales target for FY22, as its sales plus reserves as at May 31, 2022 (seven months) amounted to RM1.53 billion — 52% higher than the RM1.01 billion recorded for the same seven-month period last year.

"Embassy Gardens and London City Island continue to be the biggest contributors to sales and reservations, generating RM549 million and RM304 million respectively," it added.

EWI president and chief executive officer Datuk Teow Leong Seng noted that the group's London City Island and Embassy Gardens projects continued to lead the sales performances, while its Australian projects saw a "good uptick" in demand.

Teow said the group's strategy has been to focus on the monetisation of completed stocks at the EW-Ballymore and Australian projects and selectively evaluate new opportunities for growth towards reinvesting its cash reserves.

"Our monetisation strategy has progressed well, enabling us to repay all the project development loans for our Australian projects as well as the bank borrowings for our EW-Ballymore JV.

"At the group level we have also begun receiving some repayment of our shareholders' advance from EW-Ballymore," he added.

However, Teow said that selling prices for properties have not increased in tandem with the resurgence in demand over the last seven months.

"This is because market sentiment continues to be weighed down by inflationary concerns and rising interest rates, compounded by geopolitical tensions caused by the ongoing conflict between Russia and Ukraine," he added.

On the upside, Teow noted that rents in London — particularly at the group's EW-Ballymore projects — have been on the rise due to their prime location, transport accessibility and excellent liveability.

"Such rental growth augurs well for an eventual price recovery which should help us to achieve better overall returns from the sale of our completed properties for the benefit of our shareholders," he said.

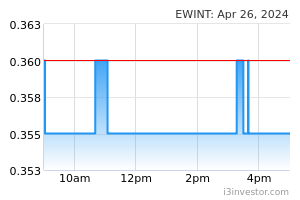

Shares in EWI ended half a sen or 1.35% lower at 36.5 sen, giving the group a market capitalisation of RM864.47 million.

Source: TheEdge - 16 Jun 2022