KUALA LUMPUR (May 30): Lay Hong Bhd posted a net loss of RM4.08 million for the financial year ended March 31, 2022 (FY22), compared with a net profit of RM3.18 million a year ago.

The retreat in full-year earnings was due to the lower production of processed chicken products, resulted from shortages of raw materials as well as manpower, the chicken product and egg producer said in a filing on Monday (May 30).

The group added that the increase in raw material costs continues to affect its input costs.

Full-year revenue rose 3.97% to RM960.31 million from RM923.66 million as its integrated livestock farming (ILF) segment and retail business enjoyed higher average selling prices, while the food manufacturing segment's revenue fell on lower production.

For the fourth quarter ended March 31, 2022 (4QFY22), Lay Hong logged a net profit of RM18.93 million versus a net loss of RM7.46 million in the corresponding quarter a year ago.

"The increase was mainly attributable to the fair valuation of biological assets at financial year end and accrual of government subsidies," the group said.

Quarterly revenue was up 6.46% to RM252.29 million from RM236.97 million in 4QFY21, also on the back of improved revenue contributions from its ILF segment and retail business while the food manufacturing segment's contribution fell.

Looking to FY23, Lay Hong said its challenge will continue to be cost containment in view of high raw material prices due to the ongoing pandemic and disrupted supply chain as a result of the Russia-Ukraine conflict.

"In addition, prices for corn and soya bean meal which account for 70% of input costs will be adversely affected [by] the strengthening US dollar," it said, also noting that the government subsidies which buoyed the group are coming to an end on June 5, 2022.

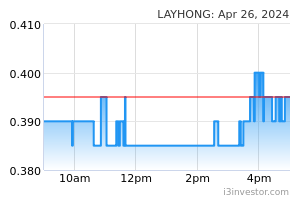

Shares in Lay Hong settled half a sen or 2.13% lower at 23 sen, giving the group a market capitalisation of RM166.73 million.

Source: TheEdge - 31 May 2022