KUALA LUMPUR (May 26): Genting Bhd's net loss for its first quarter ended March 31, 2022 (1QFY22) widened quarter-on-quarter to RM199.68 million from RM129.81 million, due to weaker performance across most key operations. The 1QFY22 net loss marked Genting’s eighth straight quarterly loss since the pandemic started.

Contribution from the leisure and hospitality division fell 12% q-o-q to RM955 million from RM1.08 billion on weaker performance across the board, with the exception of Singapore which staged growth even before its border reopening in April.

Its plantation results fell 21% q-o-q to RM253.2 million from RM320.5 million, whereas the power and property segments also posted weaker results. The oil and gas segment performed better, while loss on investments narrowed, Genting filing with Bursa Malaysia showed on Thursday.

The group also recorded higher finance costs and depreciation and amortisation in the current quarter.

Revenue for 1QFY22 fell 13% to RM4.21 billion from RM4.84 billion in 4QFY21, largely due to a 51% decline in the plantation segment's contribution to RM513.8 million, from RM1.04 billion.

On a year-on-year basis, Genting managed to narrow its net loss to RM199.68 million or 5.19 sen per share in 1QFY22, from RM331.76 million or 8.62 sen per share, as revenue rose 87% to RM4.21 billion from RM2.25 billion in 1QFY21.

This is mainly due to revenue from the leisure and hospitality division doubling to RM3.33 billion from RM1.44 billion, resulting in segment profit almost tripling to RM955 million from RM332.5 million amid the gradual economic reopening.

On prospects, Genting is positive on the longer term outlook of the leisure and hospitality industry under Genting Malaysia Bhd.

“International tourism is expected to continue its gradual recovery although weakening economic sentiments may delay the return of confidence in global travel. Nevertheless, the progressive reopening of borders and continued easing of Covid-19 restrictions will improve optimism surrounding the tourism, leisure and hospitality industries, including the regional gaming sector,” it said.

It is, however, cautiously optimistic on the recovery trajectory in Singapore. “While Genting Singapore is encouraged by the gradual increase in footfall to its integrated resort, Resorts World Singapore, Genting Singapore anticipates that the pace of recovery in leisure travel will be moderated by the limited flight schedules, high airfares and ongoing travel restrictions on visitors from certain countries."

In the oil and gas space, the front end engineering design work and environmental assessment approval for its Kasuri block in Indonesia have made good progress towards the final completion stage.

“Negotiation is on-going with potential offtaker in West Papua for the supply of natural gas which will be utilising the 1.7 trillion cubic feet of discovered gas-in-place,” it said.

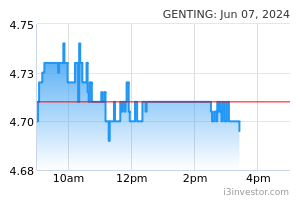

Shares of Genting Bhd closed down one sen or 0.2% to RM4.88 on Thursday, giving it a market capitalisation of RM18.92 billion.

Source: TheEdge - 27 May 2022