5G, 5th generation wireless technology, is a great enabler for IoT. It allows massive number of connected devices and sensors to communicate with each other via wireless technology, known as the Internet of Things, IoT. It is key in creating the interconnected world of the future.

N'Osairis Technology Solutions Sdn Bhd ("NTS"), a 64% subsidiary of Bursa Malaysia listed SMRT Holdings Berhad (0117), is a leading end-to-end provider of IoT solutions in South East Asia. It specializes in designing, setting up, and managing entire IoT ecosystem. It handles all the nitty-gritty details so that the clients can leverage the power of the Industry 4.0 revolution and run their businesses more efficiently than ever before. (source: https://nosairis.com/)

(source: https://nosairis.com/#services)

SMRT Holdings is exiting education business and becoming a pure play IT solutions firm. (source: https://www.theedgemarkets.com/node/654303).

In the company announcement dated 7 February, it proposed to:

i) Acquire the remaining 36% equity interest in NTS for a purchase consideration of RM72m (this values N'OSairis at RM200m)

ii) Dispose the 100% stake in SMR Education Sdn Bhd

iii) Establish a share grant plan of up to 20% of the total number of issued shares of SMRT for a duration of 10 years

(source: https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=133806&name=EA_GA_ATTACHMENTS)

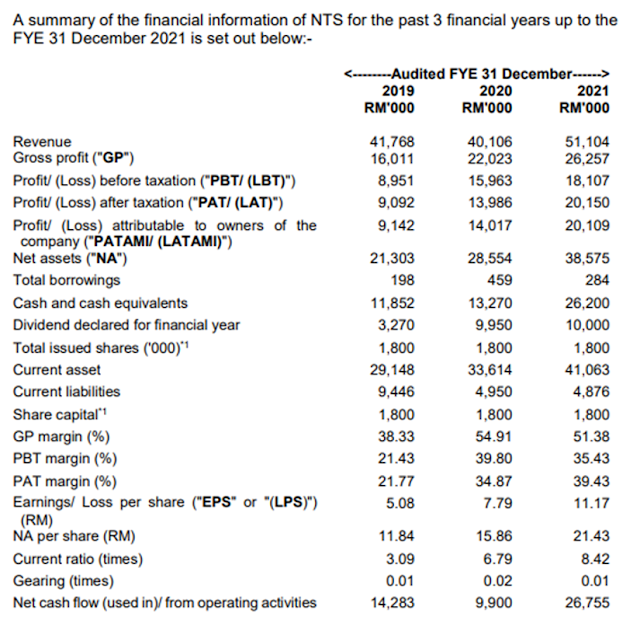

Historical revenue and PATAMI of NTS

(source: page 29 of the company announcement https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=133806&name=EA_GA_ATTACHMENTS)

NTS reported increasing PATAMI in the recent years.

| Balance sheet | as at end-2021, NTS has net cash of about RM26m. |

| PAT margin | has increased from 21.8% for FY19 to 39.4% for FY21 |

| Cash flow | strong operating cashflow |

| Dividend | has been declaring dividend with decent payout ratio of 35.8% to 49.7% |

| ROE | ROE of 56.1% and 60.0% for FY21 and FY22 respectively |

After the proposed disposal and acquisition, on pro-forma basis, the group has total borrowings of RM2.285m and likely to be in a net cash position.

| | FY19 | FY20 | FY21 | 9MFY22 |

| NTS PATAMI | 9142 | 14017 | 20109 | ? |

| NTS PAT | 9092 | 13986 | 20150 | ? |

| SMRT Tech segment PAT | 15509 | 13659 | 17470 | 19425 |

It was not disclosed how much NTS made for 9MFY22. The technology segment of SMRT has 2 subsidiaries, namely NTS (64% stake) and Talentoz Sdn Bhd (55% stake). Its 9MFY22 PAT of RM19.425m for SMRT tech segment has exceeded FY21 full-year PAT of RM17.470m.

The proposed acquisition of the remaining 36% stake in NTS at RM72m values the entire NTS at RM200m.

At a closing price of RM0.31, SMRT has a market cap of RM138.732m. If the proposals go through, for a tech company that has high profit margin, high ROE, healthy balance sheet, good cashflow and could potentially benefit from the rollout of 5G network, what is the fair target P/E multiple and market cap for the group?

Target market cap (RM'm) = target P/E (x) X Expected earnings (RM'm)

Board of directors: https://www.smrt.holdings/board-of-directors