- Overview. Sarawak Plantations Bhd (SPLB) 4Q22 core PBT came in lower following a 35% YoY drop in revenue no thanks to 1) lower average selling prices (ASP) realised of palm products, 2) lower sales volumes of CPO and PK, and 3) 6% increase in distribution and administrative expenses. On a QoQ basis, the 11% decline in core PBT was attributable to 8% and 15% decline in ASP realized of CPO and PK to RM3,861/MT and RM1,945/MT respectively, despite an increase in CPO and PK sales volumes to 114,315 tonnes (+9% QoQ) and 25,464 tonnes (+12% QoQ).

- Against estimates: Below. SPLB’s FY22 core earnings of RM103.9mn was below our estimates, making up 85% of our full year forecast, no thanks to lower production and sales volumes of CPO and PK, lower FFB purchase from external parties (-35% YoY to 319k tonnes i.e., 55% of FFB processed; FY21: 67%). The difference between reported earnings and core earnings is the fair value changes on biological assets, amounting to a loss of RM7.17mn against RM21.4mn gain in FY21.

- Key Highlights. SPLB has successfully recovered 500 ha of encumbered areas in Mukah estates in 2022 (4Q22: 280 ha; FY22: 500 ha), leaving the remaining encumbered areas as at 31 December 2022 at around 2,700 ha. Conversely, c. 760 ha remained as enhancement areas to be normalised in 2023 (4Q22: 200 ha; FY22: 400 ha).

- Outlook. We maintain our FY23/F24 earnings forecast in view of earnings performance would be sustainable given crops profile has improved and hence, could generate better yield and production growth (management guidance of circa 20%-22% in FY23). Downside risks to earnings may however come from lower-than-expected ASP realised of palm products and lower FFB purchase from external parties.

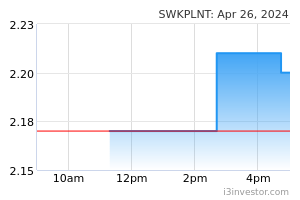

- Our call: Given challenging business outlook and moderation in palm oil prices, we revised our call to a HOLD from BUY on the stock with new TP of RM2.28 based on historical 3-year average P/BV of 0.8x that is pegged to BV/share of RM2.85. Hence, we advise investors to take any stock price rally as an opportunity to lock in their profit.

Source: BIMB Securities Research - 22 Feb 2023