- We favour Gas Malaysia Berhad (GMB) as the leading player in natural gas distribution within Peninsular Malaysia. The group’s prospects are supported by the lucrative recurring income from the pipeline asset subsequent to the liberalised gas market.

- We slashed our FY23F-24F earnings forecasts by 11%-12% however, after incorporating a lower RP2 tariff revision in its gas distribution segments, incoming Malaysia Reference Price (MRP) that is expected to normalize. This is in addition to headwinds like a prolonged Ukraine-Russian war, inflationary pressures and rising labour cost.

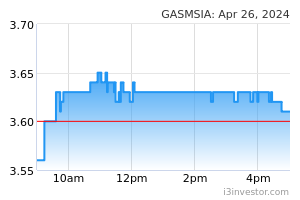

- Reiterate our BUY call on GMB with a lower TP of RM3.67 (RM3.75 previously) following our earnings downgrade. Our valuation is pegged at 12.9x PER of FY23F EPS of 28.4sen.

GMB’s Market Share to Stay Intact Despite Liberalisation

GMB announced that the current Base Average Tariff under the Incentive-Based Regulation (IBR) framework in RP2 is maintained at RM1.573/GJ/day. The tariff is for users under its Gas Malaysia Distribution (GMD) business which take effect from January 1 st 2023 until December 31st, 2025. However, a rebate of 3.8 sen will be applied exclusively in 2023, pushing the rate to RM1.535/GJ/day for all types of utilization. Notwithstanding that, we opine the tariff impact to be ‘neutral’ as the business is supported by revenue-cap adjustment element which would ensure a guarantee rate of return from its NGDS expansion projects. Apart from that, management highlighted that demand from GMB’s major industrial segment (Rubber Gloves Industries) has fallen since 3Q22 and this is expected to drop further in upcoming quarters. However, we see a muted impact from Rubber Gloves Sector as 1) GMB still hold the biggest market share in gas distribution segment as the group is the sole pipeline owner (NGDS) in Peninsular Malaysia and 2) the declining volume to be offset by the expansion of customers from consumers product, electrical and electronics and automobiles sector post economic re-opening. Note that most of GMB’s contract is for a 3-year period.

As for capex, the group is expected to allocate about RM800mn – RM850mn in RP2 and RM300mn - RM350mn in 2023. The capex amount is larger than RP1 as 1) some of pipeline project that were delayed during the Movement Control Order (MCO) to be resumed in RP2, and ii) the allocation for NGDS network expansion and upgrading. To date, GMB has commissioned 313km of pipeline network for RP1 period (2020-2022).

FY22’s Earnings Within Expectations

GMB’s 4Q22 revenue soared by 19.2% QoQ and 14.6% YoY to RM2.2bn steered mainly by higher average natural gas selling price. The price hike offset its lower natural gas volume sold during the current quarter however which stemmed from the pullback from the Rubber Gloves sector. Concurrently, FY22 core earnings rose by 56.1% YoY to RM390mn owing to higher gross profit, finance income, and contribution from the Group’s joint venture companies. On tax expenses, the effective FY22 tax rate stood at 29.0%, higher than the Malaysian statutory rate due to the impact of Cukai Makmur of 33%. Overall, the result came within our expectations at 100.5% of our full year estimate.

Dividend Payout

A second interim DPS of 8.7 sen (ex-date: 03 March and payment date: 31 March) was declared with a total FY22 DPS of 14.1 sen excluding final dividend (FY21: 17.7 sen including final dividend). GMB usually pays its dividend three times annually and the group has always maintained its dividend payment of at least 85% PATAMI (2015-2021). We expect GMB to steadily distribute FY23F-24F DPS, equivalent to a yield of >7%.

Earnings Revision

We slashed our FY23F-24F earnings forecasts by 11%-12%, after incorporating a lower RP2 tariff revision in gas distribution segments, incoming Malaysia Reference Price (MRP) that is expected to normalize and headwinds such as the prolonged Ukraine Russian war, inflationary pressure and rising labour cost.

Reiterate BUY with Lower TP of RM3.67

Maintain our BUY call on GMB with a lower TP of RM3.67 (RM3.75 previously) following our earnings downgrade. Our valuation is pegged at 12.9x PER of FY23F EPS of 28.4sen. We like GMB due to i) its ability to sustain recurring income from pipelines asset amidst market liberalization, and ii) impressive dividend policy.

Source: BIMB Securities Research - 21 Feb 2023