- TIME dotcom is partnering with affiliates of DigitalBridge Group Inc (one of the world’s largest dedicated digital infrastructure firms from US) and hence, its divestment in AIMS Group data centre.

- The aim of the partnership is to accelerate the expansion of AIMS Group data centre business across Asia

- Proceed from this divestment is expected to be paid as special dividend of up to RM1.0bn to shareholders

- We are positive on the deal as the valuation of AIMS data center is deemed fair

- No changes in earnings forecast at this juncture. We value TIME Dotcom at RM6.65 based on DCF valuation (WACC of 6.4%; and long-term growth of 1.0%).

TIME dotcom partnering with affiliates of Digital Bridge Group Inc

Based on Bursa Malaysia announcement dated 22nd November 2022, TIME Dotcom (TIME) announced that they are partnering with affiliates of DigitalBridge Group Inc (one of the world’s largest dedicated digital infrastructure firms from US) to embark on its data business expansion. TIME guided that the partnership is premised on bringing together a unique combination of two entities with distinctly different backgrounds – with a focus on telecoms and data centre operator with assets across ASEAN, and digital infrastructure investor. On top of that, the partnership will help to accelerate the expansion of AIMS Group data centre across Asia. Note that the transaction is expected to be completed by the end of 3Q23 subject to certain conditions.

RM1bn special dividend from the move

In terms of shareholding overview, there will be an immediate divestment by TIME of 49% of the ordinary shares and 100% of the irredeemable convertible preference shares in AIMS Data Centre Holding Sdn Bhd, as well as 21% of the ordinary shares in AIMS Data Centre (Thailand) (refer Figure 1). Valuation-wise, AIMS business is being valued at an enterprise value of RM3.2bn (current book value of RM240mn). Considering TIME first acquired AIMS for RM119mn in 2012, we think that the price is more-than-reasonable, a huge win for TIME. It is imperative to note that part of the RM2.0bn proceed will be partly used to pay as a special dividend of up to RM1.0bn to shareholders and the remaining balance will be reinvested for future expansion. We are positive on the partnership as this will boost TIME’s data business in ASIA particularly with increasing demand for data consumption.

Maintain BUY with unchanged TP RM6.65

Based on FYE21 TIME’s financial statements, AIMS accounted for 13% of TIME’s group revenue and earnings (EBITDA). Though the dilution may affect its bottom line but in the long run the rapid expansion of its data business across the region will be more than compensate for the dilution particularly when ASIA offers a great potential in data business especially with the full 5G network conversion by 2025.

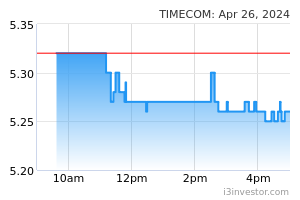

We make no change to our earnings estimates at this juncture, pending the completion of the deal. Reiterate our BUY call with DCF-derived TP of RM6.65 (WACC: 6.4%; g:1.0%). At our TP, the stock implies a 2022F PER of 27x, above its 5-year PER of 25x. We think our valuation is justified given the anticipated substantial earnings growth in 2022 due to a solid outlook for internet connectivity, leading to a higher number of new subscribers and pent-up demand for data centres and cloud services. Aside to that, we remain upbeat on TIME’s business prospects given its positive long term business outlook. We believe this is fair as we expect earnings to grow at a 3-year CAGR of 13.5% over 2021 – 2024F owing to its attractive outlook on strong demand for data and data centres coming both from retail and enterprise segments. Note that TIME’s current share price has increased by more than 6% after the group announcement on the partnership deal.

Source: BIMB Securities Research - 23 Nov 2022