- Velesto Energy (Velesto) announced that it has secured a new contract from Hess Exploration and Production Malaysia at a contract value of USD135mn. NAGA 5 rig will be assigned to drill 14 wells at the North Malay Basin for Hess beginning 4Q22 until 1Q24.

- We are positive with this contract as it will help the company to achieve higher utilization rate in FY23F.

- We expect Velesto to secure more contracts in the near future given less competition from other operators amidst a tight rig market.

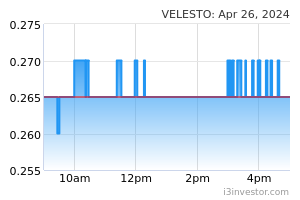

- Velesto’s stock price has gained by c.73% from its all-time low of RM0.075. Nonetheless, we still see more upside potential on the stock, hence reiterate our BUY call on Velesto with unchanged TP of RM0.28 pegged at 1x P/B to FY22F.

Secured I-RDC contract from Hess

Velesto announced that it has secured an Integrated Rig, Drilling and Completion (I-RDC) contract from Hess Exploration and Production Malaysia (Hess) for a contract value of USD135mn (or c.RM640mn). The contract entails the drilling of 14 wells for the latter’s North Malay Basin Full Field Development project. It is expected to commence in 4Q22 and it shall be completed by 1Q24. Velesto is expected to utilise its NAGA 5 rig for this contract.

Replenish Orderbook

We are positive with this contract as it will help to replenish its orderbook to RM1.1bn (2Q22: RM500mn). However, note that under I-RDC contract, the contract value is inflated by other services such as provision of vessels, crane and other supplies which carry lower margin compared to traditional drilling contract.

No Change to Earnings Forecast

Following this contract announcement, we estimate that Velesto has secured utilisation rate of at least 33% for FY23F. While this is still below our assumption of 75%, we believe it remainsintact. We expect Velesto to gain more market share in the near future as its sole local competitor is considering to sell its rig to foreign operator. To recap, its tenderbook currently stands at RM2.4bn which made up of 8 long term contracts (i.e., more than 12 months) and 20 short term contracts (less than 12 months).

Maintain BUY with Unchanged TP RM0.28

The stock price has recovered swiftly from its all-time low of RM0.075 following news of tighter rig market. However, we think there is still much upside even at current price level stemming from (i) recovery in utilisation rate and (ii) higher daily charter rate. As such, we maintain Velesto as a BUY with unchanged TP of RM0.28 pegged at 1x P/B to FY22F.

Source: BIMB Securities Research - 8 Nov 2022