- Overview. Lee Swee Kiat Group (LSKG) posted a strong 2Q22 performance amid revenue and core net profit that rose by 19.1% and 76.4% YoY respectively. The results were driven by robust domestic sales with broad-based improvement in various sales channels. It was less-than-inspiring for export segment however due to high freight cost. On QoQ basis, revenue rose slightly or by 2.7% but core earnings tumbled by 15.5%, due to higher raw material price (+19% QoQ) as well as rising staff costs due to the implementation of minimum wage since May. Overall, core profit margin declined 9.8% QoQ though it improved 3.2% YoY.

- Key Highlights. Natural latex price surged by 2.7% QoQ and 7.8% YoY due to improved global demand on the back of continued supply shortage.

- Against estimates: Above. 1H22 core net profit of RM3.1mn (+76.4% YoY) was above our forecast after accounting 58% of full year forecast though it came in line with consensus (50.1%).

- Outlook. We foresee LSKG’s earnings growth to continue to be driven by improved domestic sales due to full economic reopening though it may be offset by prolonged high freight cost that may affect its delivery for customer’s order. Note that we remain cautious on inflationary risk which may dampen consumer spending ability.

- Earnings revision. We revised our FY22 earnings forecast higher to RM12.8mn from RM11.7mn previously as we revisit our local sales growth, margins and costs to better reflect our current and future expectations of LSKG’s business operations.

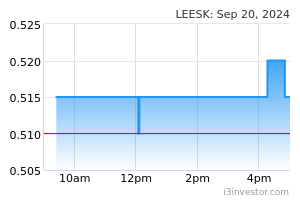

- Our call. Maintain a BUY call on LSKG with a TP of RM0.83 based on 10.1x PER that is pegged to FY23F EPS of 8.2sen. Our target price offers 18.5% capital return.

Source: BIMB Securities Research - 23 Aug 2022