Economy

US: Weekly jobless claims rise slightly more than expected . The Labor Department released a report showing a modest increase in first-time claims for US unemployment benefits in the week ended March 25th. The report said initial jobless claims rose to 198,000, an increase of 7,000 from the previous week's unrevised level of 191,000. Economists had expected jobless claims to inch up to 196,000. "Initial jobless claims ticked slightly higher last week, but remained below 200k, where they've been for 10 of last 11 weeks, a level consistent with still tight labor markets," said Nancy Vanden Houten, Lead US Economist at Oxford Economics. She added, "A tight labor market will lead to further rate hikes from the Fed, although the FOMC is likely to proceed more cautiously given the uncertain impact on the economy from the recent stress in the banking system." (RTT)

US: Economic growth downwardly revised to 2.6% in 4Q . The US economy grew by slightly less than previously estimated in the 4Q22, according to revised data released by the Commerce Department. The report said real gross domestic product shot up by 2.6% in the 4Q compared to the previously reported 2.7% jump. Economists had expected the pace of growth to be unrevised. The Commerce Department said the slower than previously estimated growth reflected downward revisions to exports and consumer spending. (RTT)

EU: German inflation eases markedly in March . Germany's consumer price inflation eased markedly in March as the sharp increase in energy prices seen over the same period last year dropped out of the annual comparison, flash estimate from Destatis showed. Consumer prices increased 7.4% YoY in March but this was notably weaker than the 8.7% increase registered in Feb. Prices were expected to climb 7.3% in March. The latest inflation was the weakest in seven months. Inflation based on the harmonized index of consumer prices, or HICP, fell to 7.8% from 9.3% in the previous month. The expected rate was forecast to ease to 7.5%. Food prices showed an above average growth of 22.3% in March. (RTT)

EU: Must cut risks in ties with 'hardening' China, says EU chief . A hardening of China's position from an era of reform and opening to one of security and control requires Europe to "de-risk" diplomatically and economically, European Commission President Ursula von der Leyen said on March 30. Ahead of next week's visit to China with French President Emmanuel Macron, von der Leyen delivered a sober assessment of Chinese policies, acknowledging that relations with Beijing have become "more distant and more difficult" in the last few years. (Reuters)

EU: Spain PM urges Asia to open market to Western companies . Spanish Prime Minister Pedro Sanchez urged Asian countries to reciprocate and open their markets to Western companies. For bilateral trade to flourish, a regulatory framework allowing domestic and foreign companies to compete on an equal footing needs to be established, Sanchez said in a speech at an economic forum in China. "This means levelling the playing field and ensuring full reciprocity between partners," he said. "It means opening up the East so the West doesn't have to close in on itself." (Reuters)

South Korea: Business confidence rises in March – BoK . Business sentiment in South Korea improved slightly in March after falling in the previous month, results of the latest survey from the Bank of Korea showed. The Business Survey Index on business conditions in the manufacturing sector rose to 70.0 in March, up from 63.0 in Feb. Also, the outlook for the following months gained to 69.0 from 66.0 in Feb. In the non-manufacturing sector, the BSI on business conditions for March was 74, up 1 points from the previous month. (RTT)

Thailand: Exports drop less than expected, rebound not seen until 2H . Thailand's customs-based exports contracted for a fifth straight month but by less than forecast in Feb, as the global economy slowed, with shipments expected to drop further in the first half of the year, the Commerce Ministry said. Exports, a key driver of growth, dropped 4.7% in Feb from a year earlier, better than a 6.9% fall forecast in a Reuters poll, and against Jan's 4.5% decline. In Feb, imports rose 1.1% from a year earlier, compared with a forecast rise of 2.1%, resulting in a trade deficit of USD1.11bn (RM4.8bn) for the month. (Reuters)

Markets

TM (Outperform, TP: RM6.20): Completes PoP project phase one installation. Telekom Malaysia (TM) has completed its new fibre optic network hub or point of presence (PoP) project phase one installations, across the northern region, Sabah and Sarawak. PoP is a place where different devices connect to each other and to the internet. In simple terms, PoP brings fibre closer to users. (StarBiz)

PTT Synergy: Acquires Pembinaan Tetap Teguh for RM152m. PTT Synergy Group has proposed to acquire 100% equity interest in Pembinaan Tetap Teguh SB (PTTSB) for RM152m. The construction company had entered into a conditional share sale agreement (SSA) with Teo Swee Phin (TSP), Teo Swee Leng (TSL) and Faddly Nordin for the proposed acquisition of 25m ordinary shares, or 100% equity interest in PTTSB. (StarBiz)

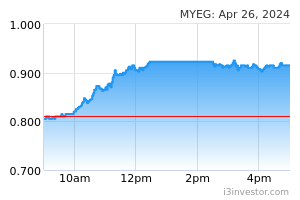

MyEG: Partners China Customs' agency to provide cross border trade facilitation services. MyEG Services (MyEG) has signed a partnership agreement with the General Administration of Customs of China (GACC) to jointly provide a full suite of cross border trade facilitation services that include certificates of origin on MyEG's blockchain platform, Zetrix. (The Edge)

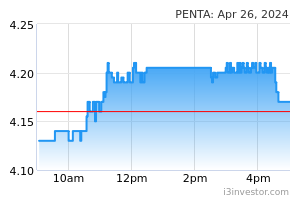

Pentamaster: Sets up German unit for expansion in Europe. Pentamaster Corp established a wholly foreign-owned limited liability company in Germany named Pentamaster Automation (Germany) GmbH (PAG). the setting up of PAG is part of the group’s expansion plan to broaden its geographical footprint into Europe. (The Edge)

Damansara Holdings: Unit fails in bid for leave to seek judicial review against IRB. Damansara Holdings’ wholly owned subsidiary Damansara Realty (Johor) SB (DRJ) has failed in its bid for leave to seek a judicial review against the Director General of Inland Revenue’s (DGIR) decision in relation to an additional assessment, with costs of RM5,000 to be paid by DRJ to the Inland Revenue Board (IRB). (The Edge)

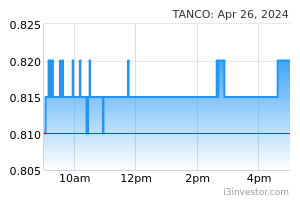

Tanco: Wins RM43.37m contract for ECRL project. Tanco Holdings has secured an engineering, procurement, construction and commissioning contract worth RM43.37m for the East Coast Rail Link project. The property firm had secured a letter of award (LoA) for the job from China Communications Construction (ECRL) SB. The LoA will enable the group to expand and strengthen its construction segment. (StarBiz)

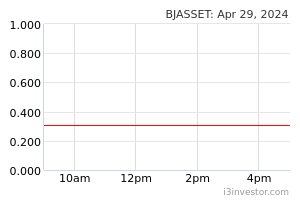

Berjaya Assets: Sells 0.36% equity interest in 7-Eleven for RM7.58m. Berjaya Assets’ (BAssets) has disposed of 3.98m shares, or 0.36% equity interest in 7-Eleven Malaysia Holdings (SEM) via a direct business transaction for RM7.58m cash, or RM1.90 per SEM share. (StarBiz)

IPO: Edelteq signs IPO underwriting agreement with UOB Kay Hian Securities. Edelteq Holdings, an engineering support provider for integrated circuit (IC) assembly and test processes, has inked an underwriting agreement with UOB Kay Hian Securities (M) SB (UOBKH) as part of its upcoming initial public offering (IPO) on the ACE Market of Bursa Malaysia Securities. (StarBiz)

Market Update

US markets took cheer in weakening labour market conditions in the belief that the Federal Reserve would be encouraged to end their rate hike program sooner than anticipated. Weekly jobless claims came in at 198,000, up 7,000 from the prior week. Markets also appear to be perceiving that the recent turmoil that brought about a confidence crisis is well contained. On the day, the Dow Jones Industrial Average and S&P 500 ended 0.4% and 0.6% higher. The Nasdaq Composite gained 0.7%. European markets also ended higher as banking concerns started to ease. Retail based shares led gainers, notably H&M after it reported a surprise first-quarter profit. Officials also voiced confidence in the resilience of the continent’s banking system. Germany’s DAX and France’s CAC 40 gained 1.3% and 1.1% as UK’s FTSE 100 added 0.7%. Asian markets were mixed earlier in the day as investors continued to monitor ongoing global developments though banking-related concerns also started to ease here. Australia’s ASX hit a 2-week high with a gain of 1.0%. The Hang Seng and Shanghai Composite indices rose 0.6% and 0.7%. Japan’s Nikkei 225 slipped 0.4% however.

Source: PublicInvest Research - 31 Mar 2023