Economy

Global: World Bank warns of ‘lost decade’ as potential growth slows. The global economy’s potential growth through the end of the decade has slowed to the weakest in 30 years, the World Bank said, citing fallout from the coronavirus pandemic and the conflict in Ukraine. Having started the millennium on a faster trajectory, the global economy’s “speed limit” — or the highest long-term rate at which it can grow without triggering inflation — is set to slow between 2022 and 2030 to 2.2% a year, the organisation said in a report. (Bloomberg)

US: Banking concerns shift from crisis to growth woes. After the collapse of two US banks and record outflows from smaller lenders, the banking industry is shifting its concern from an immediate crisis to a medium-term worry: economic growth. Deposits held by small US banks dropped by a record USD119bn to USD5.46trn after the collapse of Silicon Valley Bank on March 10, according to data released by the Federal Reserve. "We expect stress in the banking system to weigh on credit growth, which will in turn reduce real GDP growth," Goldman Sachs analysts led by chief economist Jan Hatzius wrote in a note, referring to GDP. (Reuters)

EU: German business sentiment strengthens despite banking sector turbulence. Germany's business confidence unexpectedly strengthened in March underpinned by robust improvement in expectations despite turbulence in the global banking sector, a closely watched survey suggested. The business climate index rose to 93.3 in March from 91.1 in Feb, data from the Munich-based ifo institute showed. The score improved for the fifth consecutive month. The reading was forecast to fall to 91.0. The improvement was driven primarily by business expectations. (RTT)

UK: British retailers expect sales to recover in April: CBI. UK retailers expect sales volume to return to growth next month for the first time since last Sept, survey data from the Confederation of British Industry showed. The retail sales balance fell slightly to 1% in March from 2% in Feb, the latest Distributive Trends Survey showed. Nonetheless, the balance was better than economists' forecast of -6%. A net 9% forecast sales to rise in April, marking the first positive growth expectations since Sept 2022. (RTT)

China: Economic recovery faces risks from global trade slump. China’s economic recovery was mixed in March with business confidence and the housing market improving but the global outlook darkening amid heightened financial market turmoil. Bloomberg’s latest aggregate index of eight early indicators showed growth momentum steadied from February, with the overall gauge remaining at 4. Falling car sales and weak global demand were the main drags on the index. (Bloomberg)

China: Industrial profits fall sharply. The decline in China's industrial profits deepened in the first two months of 2023 on weaker demand and falling prices, official data showed. Industrial profits plunged 22.9% on a yearly basis in Jan to Feb period, the National Bureau of Statistics reported. The decrease followed a 4.0% contraction in the full year of 2022. Data suggested that factories are yet to recover from the pandemic-driven downturn despite the removal of restrictions at the end of 2022. In Feb, factory gate prices slid 1.4% on a yearly basis after a 0.8% drop in January. Falling producer prices continue to weigh on both revenues and profits of factories. (RTT)

Hong Kong: Trade gap widens sharply as exports plunge 8.8%. Hong Kong's foreign trade deficit increased markedly in Feb, as exports fell more rapidly than imports, data from the Census and Statistics Department showed. The visible trade balance showed a deficit of HKD45.4bn, up from HKD32.1bn in the same month last year. Further, this was the biggest shortfall since June 2022. The deficit also rose considerably from HKD25.3bn in Jan. The visible trade gap of HKD45.4bn was equivalent to 13.7% of the value of imports. (RTT)

Markets

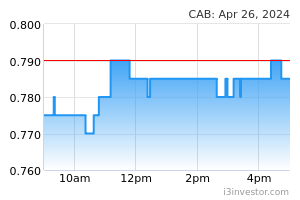

CAB Cakaran: Announces bonus issue of warrants as share price rallies to four-year high. CAB Cakaran Corp, whose share price has risen by 40.57% this month, is planning a bonus issue of up to 233.96m free warrants on the basis of one warrant for every three shares held. The exercise price of the warrants has been fixed at 63 sen apiece. This represents a 10% discount to the five-day volume weighted average market price of CAB shares up to and including March 24 of 70.01sen. (The Edge)

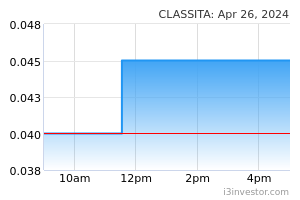

Classita: Shareholders greenlight rights issue with free warrants. Shareholders of Classita Holdings, formerly known as Caely Holdings, have approved the company’s proposed rights issue comprising the issuance of up to 965.4m shares and 579.2m detachable free warrants in the company. The Perak-based lingerie maker said the resolution was passed at its extraordinary general meeting (EGM) on March 27. (The Edge)

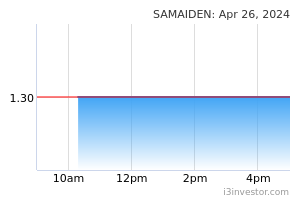

Samaiden: Obtains Bursa’s approval for transfer to Main Market. Samaiden Group has received Bursa Malaysia Securities’ nod for the transfer of its listing from the ACE Market to the Main Market. The renewable energy (RE) company involved in solar photovoltaic (PV) systems and power plants said Bursa had approved the transfer under the “Industrial Products and Services” sector. The transfer will take effect two market days upon the announcement to Bursa Securities on the transfer date to be announced later. (The Edge)

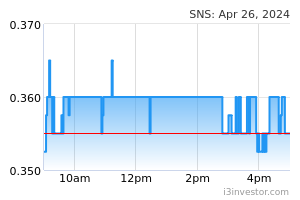

SNS Network: Logs RM16.8m profit in 4Q, declares 0.25 sen dividend. ACE Market-listed SNS Network Technology posted a net profit of RM16.77m for the fourth quarter ended Jan 31, 2023 (4QFY2023), on a quarterly revenue of RM509.86m. This translated to an earnings per share of 1.04 sen. The company declared a second interim dividend of 0.25 sen per share, with an ex-date of May 10, and payable on May 26. (The Edge)

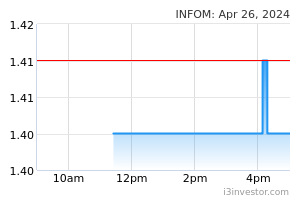

Infomina: Bags RM23.9m purchase order from Philippines National Bank. Infomina has received a USD5.4m (RM23.9m) purchase order from Philippines National Bank for technology application and infrastructure operations, maintenance and support services. The purchase order is for a period of three years from March 1, 2023, to Feb 28, 2026. Infomina managing director Yee Chee Meng said the purchase order will further strengthen its presence and foothold in the Philippines. (StarBiz)

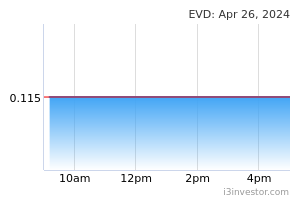

EVD: Eyes RCPS conversion, and issuance of up to 132.32m shares to meet Bumiputera equity rule. EVD will undertake a special Bumiputera issue of 132.32m new shares in order to comply with the Bumiputera equity condition set by regulators. EVD said it was part of its listing conditions to allocate 12.5% of its enlarged issued and paid-up share capital to Bumiputera investors recognised by the Ministry of International Trade and Industry (Miti) after the company achieved profit, or three years after the implementation of the regularisation plan, whichever is earlier. (The Edge)

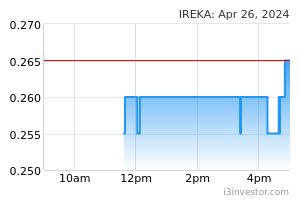

Ireka: AmBank serves writ claiming RM4.24m. Ireka Corporation and its subsidiary Ireka Engineering and Construction SB were served with a writ on March 24 from AmBank (M), claiming RM4.24m from the group. ICB said the RM4.24m included a claim on overdraft facilities amounting to RM3.1m and a claim on revolving credit amounting to RM1.14m. (The Edge)

Market Update

The FBM KLCI might open flat today as US equities were mixed on Monday, with bank stocks buoyed by investors looking beyond the turmoil that has rocked the sector in recent weeks. The KBW Nasdaq Bank index rose 2.5%, while JPMorgan Chase was up 2.9%, Citigroup up 3.9% and Wells Fargo 3.4% higher at the close. The moves echoed gains in Europe, where a 6.2% recovery in Deutsche Bank’s shares following Friday’s sharp declines led markets higher. The gains in US bank shares came as regulators confirmed First Citizens Bank would buy much of the collapsed Silicon Valley Bank, although it would lead to $20bn of losses for a deposit insurance fund paid for by US lenders. Meanwhile, the US lender First Republic’s shares rose 11.8% in the wake of reports that regulators were considering expanding an emergency lending facility for banks. Still, broader equity markets were uneven, as the gains among banks were partially offset by a decline in tech stocks that left the blue-chip S&P 500 index up 0.2% and the Nasdaq Composite down 0.5%. In Europe, the region-wide Stoxx 600 closed up 1.1%, Germany’s Dax also rose 1.1%, France’s CAC 40 added 0.9% and the UK’s FTSE 100 gained 0.9%.

Back home, Bursa Malaysia struggled to stay above the 1,400-point level on Monday amid global banking sector woes. At the closing bell, the FBM KLCI had lost 3.10 points, or 0.22%, to end at its intraday low of 1,396.60, compared with last Friday's close at 1,399.70. Stocks fell in the region after Chinese industrial profits were much weaker than expected, slumping by 22.9%. The CSI 300 fell 0.4% and the Hang Seng index lost 1.8%.

Source: PublicInvest Research - 28 Mar 2023