Economy

US: Wall St ends higher as bank contagion fears ease, Fed eyed. US stocks jumped after a deal to rescue Credit Suisse and central bank efforts to bolster confidence in the financial system relieved investors, while participants also weighed the likelihood of a pause in rate hikes from the Federal Reserve this week. UBS, late on Sunday agreed to buy rival Credit Suisse, for USD3.23bn, in a merger engineered by Swiss authorities to avoid more turmoil in the banking group. Also, major central banks moved on Sunday to bolster the flow of cash around the world. Investors are also focused on the Fed's decision when policymakers conclude a twoday meeting on Wednesday. Fed funds futures now show a 28.4% probability of the Fed holding its overnight rate at 4.5%-4.75%, and a 71.6% likelihood of a 25 basis-point increase. (Reuters)

EU: Eurozone trade gap narrows in Jan. Euro area trade deficit narrowed at the start of the year as the pace of fall in imports exceeded the decline in exports, official data revealed. The deficit on trade in goods decreased to a seasonally adjusted EUR11.3bn in Jan from EUR13.4bn in Dec, Eurostat reported. The monthly fall in exports slowed to 1.1% in Jan from 2.8% in Dec. Likewise, imports dropped at a slower pace of 1.8% after easing 2.9% a month ago. However, the non-adjusted trade deficit increased to EUR30.6bn in Jan from EUR30.2bn in the same period last year due to higher cost of imported energy. (RTT)

EU: German GDP to fall slightly in Q1. The German economy is likely to fall in the first quarter but the decline will be slower than in the final quarter of 2022, Bundesbank said in its monthly report. The largest euro area economy had contracted 0.4% in the fourth quarter of 2022. The second consecutive quarter of contraction suggests that the economy entered a technical recession. Despite the current weakness in the economy, Bundesbank said the labour market remained slightly positive. The jobless rate is forecast to fall slightly in the coming months. Inflation is expected to decline significantly in March due to the base effect. But the bank said core inflation is proving to be extraordinarily persistent. (RTT)

UK: House prices rise in March. After flattening in Feb, UK house prices increased in March due to a jump in the larger home top-of the-ladder sector, property website Rightmove said. The average price of property coming to market grew 0.8% on a monthly basis in March, following a nil growth in Feb. Nonetheless, the 0.8% increase was below the average monthly rise of 1.0% seen in the month of March over the last 20 years, reflecting a higher degree caution among new sellers. The overall house price inflation was driven by the 1.2% increase in larger home prices. (RTT)

China: Retains benchmark lending rates as expected. China retained its benchmark lending rates for the seventh straight month after a surprise reserve requirement ratio reduction last week. The People's Bank of China left its one-year loan prime rate, or LPR, unchanged at 3.65%. Similarly, the five-year LPR, the benchmark for mortgage rates, was maintained at 4.30%. The last change in the LPR was in Aug 2022, when the five-year rate was cut by 15 basis points and one-year rate by 5 basis points. The LPR is fixed monthly based on the submission of 18 banks, though Beijing has influence over the rate-setting. (RTT)

South Korea: Producer prices rise 0.1% in Feb. Producer prices in South Korea were up 0.1% on month in Feb, the Bank of Korea said slowing from 0.4% in Jan. Individually, prices for agricultural, forestry and marine products fell 0.2% on month, while manufacturing products rose 0.1%, utilities fell 0.3% and services added 0.3%. On a yearly basis, producer prices climbed 4.8%, easing from 5.1% in the previous month. Individually, prices for agricultural, forestry and marine products climbed 5.5% on month, while manufacturing products rose 2.9%, utilities skyrocketed 29.5% and services added 3.4%. (RTT)

Markets

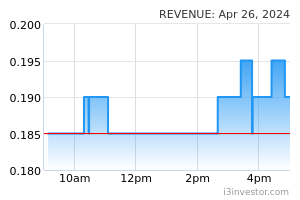

Revenue: Ng brothers exit Revenue Group board. Two and a half months after their executive functions were suspended, Revenue Group executive directors Brian Ng Shih Chiow and Dino Ng Shih Fang have resigned from the board of the e-payments service provider. Brian and Dino’s departure from the board effective Monday (20 March) was due to them not wanting to be on the same board of directors with the current directors. While the brothers have vacated their executive director post, Dino remains as the group’s largest shareholder with 85.38m shares or a 17.71% stake. (The Edge)

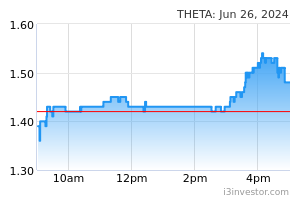

Theta Edge: Gets contract termination notice from IJN. Theta Edge has received a contract termination notice from Institut Jantung Negara SB. Its wholly-owned subsidiary, Theta Technologies SB, was awarded the contract on 25 Feb 2021. The contract was to supply, conduct requirement study, design, develop or customise, configure, integrate, data migration, install, test, training, support and maintain hospital information systems and electronic medical record. (StarBiz)

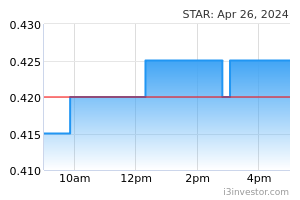

Star Media: MCA ups stake while ASB steadily trims. MCA has been steadily increasing its shareholding in Star Media Group since Aug 2022 by acquiring 9.29m shares, upping its stake by 1.27% to 327.46m shares or 45.18%, while ASB has been trimming its stake in the media group since the start of this year. Of MCA's latest shareholding, 14.15m shares or 1.952% are indirectly held, Star Media's. Its latest acquisition involves 892,500 shares, acquired via its investment arm Huaren Holdings SB. Prior to Aug 2022, MCA held 318.17m shares or 43.89%. (The Edge)

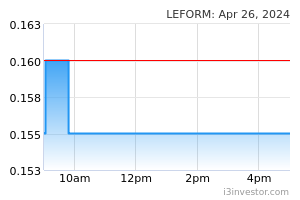

Leform: Wins RM19.53m contract from IJM. Leform has secured a contract worth RM19.53m from IJM SB to supply and install guardrails at Section 11 of the Beruas Interchange to Taiping South Interchange. The work is expected to be completed by 30 Aug 2023. Leform managing director Law Kok Thye said the contract marks the continuous effort towards securing projects since becoming a listed entity. (StarBiz)

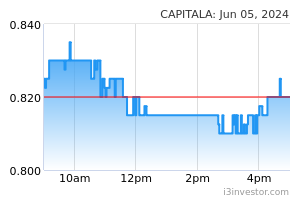

Capital A: Airasia Super App to have new CEO on 1 April. Mohamad Hafidz Mohd Fadzil will be helming Airasia Super App, the region’s leading travel and mobility super app, as its CEO effective 1 April. He would take over the reins from the current CEO Amanda Woo who would be stepping down. Mohamad Hafidz whose experience in building Capital A’s vast payment infrastructure would help drive future growth for its digital portfolio. This follows the recent leadership transition announcement at Airasia Digital, which include the subsidiaries, Airasia Super App and BigPay. (StarBiz)

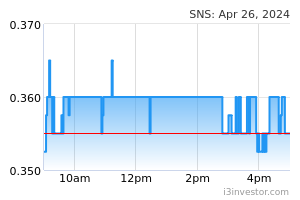

SNS Network: To supply apple products, accessories to Kumon Malaysia. SNS Network Technology’s wholly-owned subsidiary, SNS Network (M) SB has signed a collaboration agreement with Kumon Education (Malaysia) SB (Kumon Malaysia) for the supply of Apple iPad products and accessories. As part of the agreement, SNS will create and maintain a portal from which Kumon Malaysia’s parents and students can access while also undertaking all services related to the supply of Apple iPad products and accessories. (StarBiz)

Market Update

US markets rebounded overnight even as banking-related news dominated headlines while investors continue to cast a wary eye on the US Federal Reserve’s rate hike decision due out tomorrow. Traders are pricing in a 77% chance of a 0.25% hike, with the probability of a pause at 23%. On banks, currently-embattled First Republic Bank is said to be getting advice from JP Morgan Chase on strategic alternatives. On the day, the Dow Jones Industrial Average and S&P 500 gained 1.2% and 0.9% while the Nasdaq Composite inched 0.4% higher. European markets were also higher despite Credit Suisse-UBS jitters, a shock development over the weekend which saw UBS acquiring Credit Suisse (CS) for USD3.2bn in a reportedly “forced” move (rescue) engineered by the Swiss government. Shares of the latter (CS) slumped 56% though UBS’ gained 1.2%. France’s CAC 40 and Germany’s DAX rose 1.3% and 1.1% as UK’s FTSE rose 0.9%. Asian markets were mostly lower as news of the collapse of 167-year old Credit Suisse Group AG reverberated across markets. The Hang Seng Index was hardest hit in the region, slumping 2.7%. Elsewhere, Japan’s Nikkei 225 and China’s Shanghai Composite Index fell 1.4% and 0.5%.

Source: PublicInvest Research - 21 Mar 2023