Economy

US: Foreign holdings of US Treasuries rise for 3rd month in Jan as yields decline. Foreign holdings of US Treasuries rose for a third straight month in Jan, with yields continuing their decline as investors reckoned that the Fed was nearing the end of its tightening cycle. US economic data during the month showed signs of slowing down as the Fed’s past rate increases started to take their toll on the economy. Offshore holdings rose to USD7.40trn in Jan from USD7.32trn the previous month. But compared with a year earlier, Treasuries held by foreigners fell 3.3% in Jan. (RTT)

US: Producer prices unexpectedly edge down 0.1% in Feb. Producer prices in the US unexpectedly edged slightly lower in the month of Feb. The Labor Department said its PPI for final demand slipped by 0.1% in Feb after rising by a downwardly revised 0.3% in Jan. Economists had expected producer prices to increase by 0.3% compared to the 0.7% advance originally reported for the previous month. The report also showed the annual rate of growth by producer prices slowed to 4.6% in Feb from 5.7% in Jan. The YoY growth was expected to slow to 5.4%. (RTT)

US: Retail sales dip amid sharp pullback in auto sales. Retail sales fell by 0.4% in Feb after spiking by an upwardly revised 3.2% in Jan. Economists had expected retail sales to decrease by 0.3% compared to the 3.0% surge originally reported for the previous month. The decrease in retail sales largely reflected a sharp pullback in sales by motor vehicle and parts dealers, which tumbled by 1.8% in Feb after soaring by 7.1% in Jan. Excluding the steep drop in sales by motor vehicle and parts dealers, retail sales edged down by 0.1% in Feb after jumping by 2.4% in Jan. (RTT)

US: Tariffs on metals, some China goods raised American prices. US importers bore almost the entire burden of tariffs that President Donald Trump placed on more than USD300bn in Chinese goods, raising the cost of goods bought by American companies. The US International Trade Commission, a bipartisan entity that analyzes trade issues, found an almost one-to-one increase in the price of US imports following the so-called section 301 tariffs. The report came in response to a directive from Congress as part of a law passed last year. (Bloomberg)

EU: Industrial output recovers in Jan. Eurozone industrial production recovered in Jan driven by a rebound in intermediate goods output. Industrial production posted a monthly growth of 0.7% after falling 1.3% in Dec. The growth rate also exceeded economists' forecast of 0.4%. The expansion was solely driven by the 1.5% rise in intermediate goods output. All other sub-sectors contracted from Dec. Non-durable consumer goods production registered the biggest fall of 2.1%. This was followed by a 0.8% drop in energy output and 0.7% decline in durable consumer goods output. Production of capital goods fell only 0.2%. (RTT)

UK: Government says economy to shrink 0.2% this year but avoid technical recession. The UK economy is set to contract this year yet avoid a technical recession due to the changing global developments and support measures taken by the government. The Office for Budget Responsibility (OBR), forecast the economy will not enter a recession at all this year with a contraction of just 0.2%. The unemployment rate is projected to rise by less than one ppt to 4.4%, with 170,000 fewer people out of work compared to the Autumn forecast. (RTT)

China: Industrial output, retail sales rise. China's industrial production and retail sales expanded in Jan to Feb period. Industrial output grew 2.4% YoY in Jan to Feb period, faster than the 1.3% increase posted in Dec. Production was forecast to grow 2.6%. Retail sales advanced 3.5% from the last year, in contrast to the 1.8% decline in Dec. The rate came in line with expectations. In the first two months of the year, fixed asset investment increased 5.5% annually, which was bigger than economists' forecast of 4.4%. (RTT)

Indonesia: Feb trade surplus at USD5.48bn, beats forecast. Indonesia reported a larger than forecast trade balance in Feb at USD5.48bn, boosted by an unexpected drop in imports. Analysts polled by Reuters had expected a USD3.27bn trade surplus. Feb's trade surplus also marked an increase from Jan's USD3.87bn and was the biggest since Oct. Exports in Feb rose 4.5% annually to USD21.40bn, slightly lower than a 5.0% growth expected by analysts and after a 16.4% increase in Jan. Imports fell by 4.3% annually to USD15.9bn due to a drop in purchases of raw materials and machinery. (RTT)

New Zealand: GDP sinks 0.6% in Q4. New Zealand's GDP contracted a seasonally adjusted 0.6% QoQ in the 4QFY22. That missed forecasts for a decline of 0.2% following the downwardly revised 1.7% increase in the three months prior (originally 2.0%). On an annualized basis, GDP climbed 2.2%, again shy of expectations of 3.3% following the 6.4% increase in the 3Q. GDP rose 2.4% over the year ended FY22. (RTT)

Markets

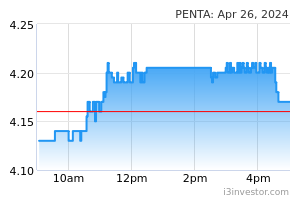

Pentamaster: Withdraws stake subscription in Taiwanese optoelectronics manufacturer Epic. Pentamaster Corp has withdrawn its subscription of a 29.9% stake in the enlarged capital of Taiwan-based Everready Precision Industrial Corp (Epic). Pentamaster did not provide a reason for the withdrawal, but would pursue the return of the investment sum of USD6.8m from Epic. (The Edge)

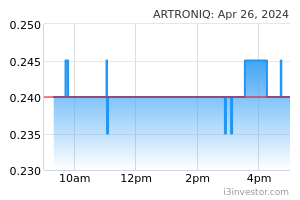

Artroniq: Wins USD10m blockchain R&D contract from Cambodian bank. Artroniq has accepted a LoA from Panda Commercial Bank plc for a R&D blockchain based financial services contract valued at USD10m (RM44.8m). The contract is for a period of 2 years, starting from March 15 this year to March 31, 2025. The award pertains to the development of basic blockchains, functional API, web and mobile related solutions applicable for Panda Bank. (The Edge)

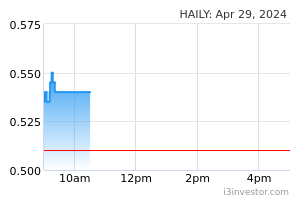

Haily: Bags RM33m job to build houses in Johor, sees stronger year in 2023. Haily Group has secured a RM32.7m contract to build 186 units of single-storey terrace houses in Bandar Putra Kulai, Johor. The contract was awarded by of Nice Frontier SB, a member of the IOI Properties Group. The construction is expected to be completed in 15 months or by June 26, 2024. (The Edge)

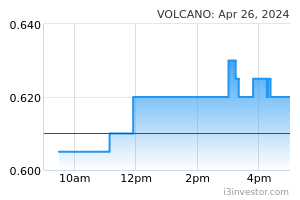

Volcano: To raise RM43m via private placement to fund expansion plan. The placement shares will be priced at not more than a 10% discount to Volcano shares’ five-day VMAP. The group may raise up to RM42.8m, of which RM38m will be used to fund the construction of new factories in Penang and Rayong in Thailand. Another RM3.3m will go towards general working capital, with the remaining proceeds to be used for expenses of the placement exercise. (The Edge)

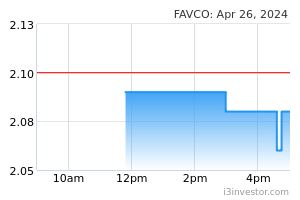

Favelle Favco: Wins two contracts worth RM95m. Construction crane manufacturer Favelle Favco (FFB) has secured two contracts with a combined value of about RM95m. One of them is a contract for the supply of a tower crane, awarded by Samsung Heavy Industries Co Ltd. The other contract is for the supply of an offshore crane, awarded by Malaysia Marine and Heavy Engineering SB. The cranes are expected to be delivered by 2Q2024. (The Edge)

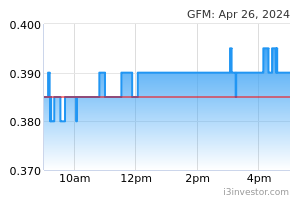

GFM: Buys 100% stake in Atmajaya for RM9m. GFM Services has proposed to acquire a 100%-stake in Atmajaya Arvino SB for RM9m. The acquisition would enable GFM to design, build, operate, and maintain a rest and service area (RSA) along the Kuala Lumpur-Karak Highway. Atmajaya was awarded the approval by the Malaysian Highway Authority to construct and maintain the RSA in Karak, Bentong. (StarBiz)

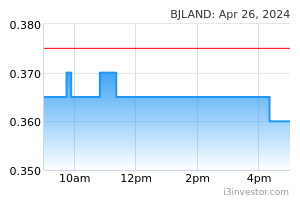

Berjaya Land: Buys 0.61% equity interest in 7-Eleven for RM12.1m. Bland has acquired 6.7m ordinary shares representing about 0.61% equity interest in 7-Eleven Malaysia Holdings (SEM) for RM12.1m cash. BLand acquired SEM shares from a non-related party and True Ascend SB via direct business transactions. Following the acquisitions, BLand hold a total of about 68.6m SEM shares representing about 6.18% equity interest in SEM. (StarBiz)

Market Update

US markets were volatile in overnight trading as investors continue to monitor developments in the country’s banking system, while also keeping an eye on Europe’s. Major benchmarks had a rocky start in the morning following news that Credit Suisse’s largest investor, the Saudi National Bank, said that it could not provide additional funding for the bank. The announcement sparked a broad selloff over fears of a crisis in the financial sector. Some ground was regained in the afternoon after an announcement from a Swiss regulator stated that the Swiss National Bank would provide additional liquidity to Credit Suisse if necessary. On the day, the Dow Jones Industrial Average and S&P 500 fell 0.9% and 0.7% though the Nasdaq Composite inched 0.1% higher. European bourses were hammered however, with banking stocks falling deep into negative territory amid the current turmoil. The oil and gas and mining sectors fared no better. Market-wise, Germany’s DAX and France’s CAC 40 slumped 3.3% and 3.6% respectively. UK’s FTSE 100 tumbled 3.8% while Italy’s FTSE MIB was 4.6% lower. Most Asian markets traded higher earlier in the day in positive reaction to Wall Street’s rebound the day before, though very likely to trade in the red today. Economic data out of China continues to solidify opinion over the country’s post-pandemic recovery. The Shanghai Composite and Hang Seng indices rose 0.6% and 1.6%. Japan’s Nikkei 225 was flat.

Source: PublicInvest Research - 16 Mar 2023