Economy

US: Odds of 50-basis-point Fed rate hike rise after Powell testimony. Traders of futures tied to the Federal Reserve's policy rate were pricing in a half-percentage-point hike in interest rates at the US central bank's March 21-22 policy meeting after Fed Chair Jerome Powell said that continued strong inflation data could require tougher measures. Implied yields on fed funds futures contracts fell, pointing to a 48% probability that the central bank will lift its benchmark overnight interest rate to the 5.00%-5.25% range on March 22, from the current 4.50%-4.75% range, according to CME Group's FedWatch tool. (Reuters)

US: Twelve US senators back giving Commerce secretary new powers to ban TikTok. A bipartisan group of 12 US senators will introduce legislation that would give Commerce Secretary Gina Raimondo new powers to ban Chinese-owned video app TikTok and other foreign-based technologies if they pose national security threats, Senator Mark Warner said. "I think it is a national security threat," Warner said on CNBC, adding that the bill would give Raimondo "the ability to do a series of mitigation up to and including banning" TikTok and other technologies that pose national security risks. (Reuters)

EU: German factory orders unexpectedly strengthen. Germany's factory orders unexpectedly expanded in January on strong foreign demand for aircraft and spacecraft construction and automobile engines, figures from Destatis revealed. Factory orders grew 1.0% in Jan from Dec, confounding expectations for a decline of 0.9%. Nonetheless, the pace of growth eased from Dec revised 3.4% expansion. Excluding large scale orders, there was an increase of 2.9% in new orders. YoY, manufacturing new orders declined at a faster pace of 10.9% after falling 9.9% in Dec. (RTT)

EU: Spain industrial production falls in Jan. Spain's industrial production contracted in Jan due to the declines in energy and intermediate goods output, data from the statistical office INE showed. Industrial production declined by adjusted 0.4% on a yearly basis, in contrast to the 0.7% increase in Dec. Meanwhile, on an unadjusted basis, industrial output posted an annual growth of 1.2% after a 3.1% fall. The adjusted annual decline was driven by the 4.1% fall in intermediate goods and the 3.8% decrease in energy output. (RTT)

EU: Greek economy expands 1.4% in Q4. Greece's economic growth improved in the final quarter of 2022 amid a strong rebound in household consumption, preliminary figures from the Hellenic Statistical Authority showed. GDP advanced a seasonally adjusted 1.4% quarterly in the three months ended Dec, faster than the revised 0.4% rise in the Sep quarter. The annual economic growth also accelerated to 5.2% in the 4Q from 4.4% in the 3Q. On the expenditure side, total final consumption rose 1.2% from the previous quarter, when it contracted by 0.9%. (RTT)

UK: House prices rise at fastest pace in 8 months. Despite the cost of living crisis, UK house prices increased the most in eight months in Feb underpinned by improving consumer confidence and the resilient labour market, data from the Lloyds Bank subsidiary Halifax and S&P Global showed. House prices logged a monthly increase of 1.1% in Feb, faster than the 0.2% increase posted in Jan, while economists had forecast a 0.3% fall. This was the second consecutive increase and also marked the fastest growth since June 2022. (RTT)

China: Exports continue to fall on weak global demand. China's exports continued to decline at the start of the year, reflecting the challenges posed by the global economy that constrained the ability of Beijing to set robust growth target. Exports declined 6.8% in the Jan to Feb period from the same period last year, the General Administration of Customs reported. The annual decrease was slower than the 9.9% drop posted in Dec and also better than economists' forecast of 9.4% fall. (RTT)

Australia: Hikes key rate to near 11-year high. Australia's central bank hiked its key interest rate by a quarter-point to a more than 10- year high and signalled more tightening to combat high inflation. The policy board of the Reserve Bank of Australia decided to lift the cash rate target by 25 basis points to 3.60%. The decision was as widely expected. The interest rate on Exchange Settlement balances was also raised by 25 basis points to 3.50%. (RTT)

Australia: Retail sales rise 1.9% in Jan. The total value of retail sales in Australia was up a seasonally adjusted 1.9% on month in Jan, the Australian Bureau of Statistics said coming in at AUD35.091bn. That was in line with expectations following the 3.9% decline in Dec. Individually, sales were up for food, household goods, clothing, department store sales, cafes and restaurants and other retailing. On a yearly basis, retail sales advanced 7.5%. (RTT)

Philippine: Inflation eases slightly to 8.6%. The Philippines' consumer price inflation slowed marginally in Feb from a more than 14-year high in Jan amid a slowdown in transport charges, data from the Philippine Statistical Authority showed. The consumer price index, or CPI, climbed 8.6% YoY in Feb, slightly slower than the 8.7% rise in Jan. Meanwhile, economists had forecast inflation to rise further to 8.8%. The core inflation rate, which excludes the prices of selected food and energy items, also moderated to 7.6% in Feb from 7.8% in Jan. (RTT)

Markets

Sime Darby Plantation (Neutral, TP: RM4.60) : Aims for 100 % local workers by 2027 . Sime Darby Plantation Bhd (SDP) aims to be the anchor for utilising mechanisation, automation and digitalisation in the oil palm plantation as the country aspires to reduce its dependency on foreign labour. It said in line with the aspiration, SDP targeted 100% local workers by the end of 2027, with a minimum wage of RM3,000. The end game is to reduce the manpower and as much as possible to recruit our locals. (Bernama)

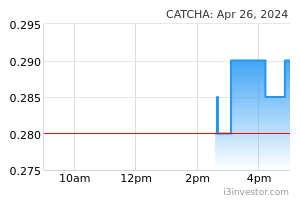

Catcha Digital: Completes acquisition of iMedia Asia . Catcha Digital has completed the acquisition of the entire equity interest of iMedia Asia SB for RM43.9m in cash and shares. Catcha Digital now owns a fast-growing integrated digital media solutions provider, with an extensive portfolio of digital marketing platforms, reaching 12.7m Malaysians in Jun 22 and services over 100 brands spanning across various industries. (StarBiz)

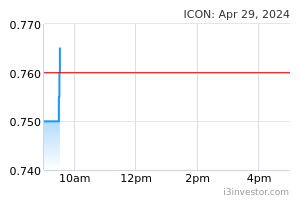

Icon Offshore: Proposes capital reduction, share consolidation. Icon Offshore has proposed to reduce its issued share capital by RM830m to eliminate the accumulated losses of the company and its group of subsidiaries. The company has also announced a proposed consolidation of every five existing ordinary shares in the company held by its shareholders. (Bernama)

Uda Holdings: Issues sukuk wakalah worth RM1bn. UDA Holdings will issue a RM1bn sukuk wakalah Islamic medium-term notes (IMTN) programme and Islamic commercial papers (ICPs). UDA is an agency under the Entrepreneur Development and Cooperatives Ministry (Kuskop). The fund from the sukuk wakalah issuances would be used as working capital for the financing of project, development of commercial, housing, industrial as well as wakaf projects. (Bernama)

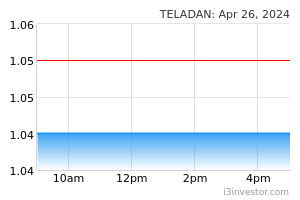

Teladan Setia: Buys Negeri Sembilan land for RM24.1m. ACE Market-listed property firm Teladan Setia is acquiring freehold land in Negeri Sembilan for RM24.1m in cash. The land, measuring 70,020 sqm, is planned for mixed development. “This proposed acquisition is in line with our strategy of replenishing our land bank at locations with strong growth potential and to scale up our property development activities to generate long-term sustainable income,” it added. (The Edge)

Pavilion REIT: Seeks shareholders' approval to acquire Pavilion Bukit Jalil mall for RM2.2bn . The proposed acquisition will be discussed in the extraordinary general meeting to be held on 22 Mar. The proposed acquisition of PBJ Mall aligns with Pavilion REIT’s strategy to expand its portfolio of prime retail assets in Malaysia to six from its current portfolio that consists of Pavilion Kuala Lumpur, Elite Pavilion Mall, Intermark Mall, Da Men Mall and Pavilion Tower. (Bernama)

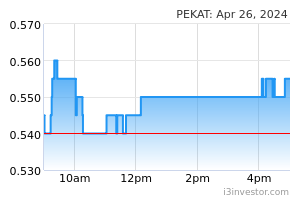

Pekat Group: Says business as usual despite lawsuit over supply of solar PV systems. ACE Market-listed Pekat Group said it is business as usual for the solar photovoltaic (PV), earthing and lightning protection group although its unit is facing a RM2.2m lawsuit. The suit filed against the group’s wholly-owned subsidiary Pekat Solar SB from Multiplex Packaging SB concerns a dispute over the supply and installation of two solar PV systems. (The Edge)

Market Update

The FBM KLCI might open lower as Wall Street stocks declined and the yield on short-term US government debt soared after Federal Reserve chair Jay Powell warned that the central bank could more aggressively raise interest rates if the economy grows too quickly. Powell’s comments sent the yield on the policy-sensitive two-year US Treasury above 5% for the first time since 2007, pushing a closely watched recession indicator to its lowest level since 1981 and prompting a rally in the US dollar. Wall Street’s benchmark S&P 500 fell 1.5%, weighed down by financials. The tech-heavy Nasdaq Composite dropped about 1.2%. Losses in New York accelerated in the afternoon after Powell warned in congressional testimony that if economic data indicated “that faster tightening is warranted, we would be prepared to increase the pace of rate hikes”. European stocks mostly declined on Tuesday, with the region-wide Stoxx 600 down 0.8%. London’s FTSE 100 declined 0.1%.

Back home, Bursa Malaysia rebounded on Tuesday to end higher after the key index recorded two straight days of meagre losses as bargain-hunting activities emerged, amid the upbeat performance in most regional peers. At the closing bell, the benchmark FBM KLCI rose 5.99 points or 0.41% to 1,458.67 from Monday’s closing of 1,452.68. Chinese equities also slipped after disappointing trade data added to investors’ concerns that the country’s post-zero Covid recovery might prove less explosive than previously expected. China’s CSI 300 fell 1.5% and Hong Kong’s Hang Seng index lost 0.3% after imports in January and February declined 10.2% compared with the same period a year earlier.

Source: PublicInvest Research - 8 Mar 2023