Economy

US: Manufacturing sector still shrinking; raw material prices rebound. US manufacturing contracted for a fourth straight month in Feb, but there were signs that factory activity was starting to stabilize, with a measure of new orders pulling back from a more than 2-1/2-year low. The survey also showed prices for raw materials increasing last month, which the ISM partly attributed to "a return to more balanced supplier-buyer relationships, as sellers are more interested in filling order books and buyers now see the need to reorder. The survey also hinted at buyer resistance to higher prices. Nevertheless, the rebound in prices at the factory gate suggests inflation could remain elevated for a while after monthly consumer and producer prices surged in Jan. (Reuters)

US: Construction spending falls in Jan . US construction spending unexpectedly fell in Jan as investment in single-family homebuilding continued to decline. The construction spending dipped 0.1% in Jan after dropping 0.7% in Dec. Economists polled had forecast construction spending rising 0.2%. Construction spending increased 5.7% on a YoY basis in Jan. The housing market has been hammered by the Fed’s aggressive monetary policy tightening, with residential investment contracting for seven straight quarters, the longest such stretch since 2009. (Reuters)

US: Mortgage interest rates remain at highest level since Nov. The average interest rate on the most popular U.S. home loan remained last week at its highest level since Nov as stronger-than expected readings on inflation, job gains and consumer spending caused investors to hike their bets that the Fed will have to keep raising its policy rate through the summer. The average contract rate on a 30-year fixed-rate mortgage increased by 9bps to 6.71% for the week ended 24 Feb, a third weekly rise in mortgage rates after several weeks of declines. (Reuters)

EU: German EU-harmonised consumer prices up 9.3% YoY in Feb. German consumer prices, harmonised to compare with other EU countries, rose by a more than anticipated 9.3% on the year in Feb. Compared to Jan, prices increased by 1.0%, it added. Analysts had expected harmonised data to increase by 0.7% on the previous month and grow by 9.0% on an annual basis. The statistics office offers a breakdown for Feb figures on its website. (Reuters)

EU: Manufacturing activity continues to shrink. Euro area factory activity continued to contract in Feb despite production ending an eight-month sequence of decline amid the easing supplier bottlenecks and improved raw material availability. The manufacturing PMI fell to 48.5 in Feb from 48.8 in Jan. The reading came in line with the flash estimate. A score below the neutral 50.0 suggests contraction in the sector. The survey showed that production broadly stabilized in Feb partly due to the improvements in the supply of raw materials and speedier deliveries from vendors. (RTT)

China: Factory activity stuns with fastest growth in a decade. China's manufacturing activity expanded at the fastest pace in more than a decade in Feb, an official index showed on Wednesday, smashing expectations as production zoomed after the lifting of COVID-19 restrictions late last year. The manufacturing PMI shot up to 52.6 from 50.1 in Jan, above the 50-point mark that separates expansion and contraction in activity. The PMI far exceeded an analyst forecast of 50.5 and was the highest reading since April 2012. (Reuters)

China: Economy sputters just shy of high-income status. China came within a few hundred dollars of attaining high-income nation status last year, as the economic slowdown and weak yuan blunted individual and corporate incomes. The World Bank defines a high income nation as one with a nominal GNI per capita above USD13,205. China logged in at USD12,608 last year. In 2021, China's zero-COVID policies were effective in containing the pandemic responsible for normalizing economic activity, and the per capita GNI soared by more than 20% that year. However, the GNI crept up by only 0.9% last year, largely due to the economy stalling on prolonged adherence to strict zero-COVID rules. (Nikkei Asia)

India: Manufacturing sector maintains strong growth momentum. India's factory activity continued to expand strongly in Feb, driven by robust growth in output and new orders. The manufacturing PMI, dropped slightly to 55.3 in Feb from 55.4 in Jan. However, a reading above 50 indicates expansion in the sector. In Feb, new orders increased for the 20th consecutive month, owing to favorable demand conditions and successful marketing campaigns. Domestic demand drove the continued increase in new orders, while export orders fell slightly from Jan. Output also expanded further and at a sharp pace on the back of sustained rises in new orders, favorable underlying demand, and technological progress.. (RTT)

Indonesia: Manufacturing PMI slips to 51.2. The manufacturing sector in Indonesia continued to expand in Feb, albeit at a slightly slower rate, the latest survey a PMI score of 51.2. That's down from 51.3, although it remains above the boom-or-bust line of 50 that separates expansion from contraction. Growth of manufacturing production in Indonesia was sustained in Feb, with the rate of increase the joint fastest since last Sep. Higher output was supported by an expansion in new orders on the back of better underlying demand conditions and broader customer bases. (RTT)

Australia: CPI moderates. Australia's CPI moderated in Jan but remained at elevated level. The monthly CPI advanced to 7.4% YoY in Jan, slower than the 8.4% increase in Dec. However, this was the second highest annual increase since the start of the monthly CPI indicator series in September 2018, signifying ongoing high inflation. The most significant contributors to the annual increase were housing, food and non-alcoholic beverages and recreation and culture. (RTT)

Markets

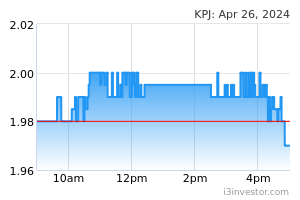

KPJ Healthcare (Outperform, TP: RM1.25): KPJ sells Indonesian hospital operations. KPJ Healthcare has entered into a share sale agreement for the proposed disposal of its Indonesian hospital operations and facilities involving KPJ Medica for a total consideration based on an enterprise value of RM150.2m. (The Edge)

Comments : Indonesian operations have 2 hospitals with a total of 170 operating beds (representing 6% of the total operating beds in KPJ). However, the operation reported a loss of RM7.7m in FY22 compared to the group’s full-year profit of RM76.3m. KPJ is expected to recognize a gain on disposal of RM60m in FY23, assuming the disposal will complete by 1QFY23. We make no changes to our core earnings forecast and maintain our Outperform call on KPJ.

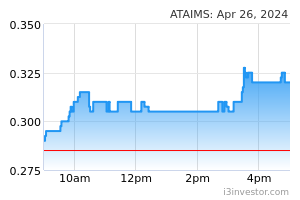

ATA IMS: Faces RM20m suit . ATA IMS has been served a writ of summons and statement of claim by Hong Kong-based Johnson Electric Industrial Manufactory Ltd. ATA IMS said Johnson is claiming damages totalling some RM20m (USD4.4m) being payment for finished goods in accordance to invoices issued, payment for the raw materials pursuant to the debit note, storage costs and testing fees among other. (StarBiz)

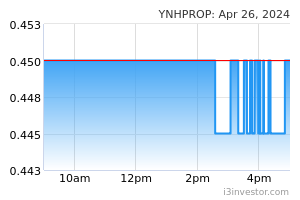

YNH: Gets nod to RM422.5m assets sale . YNH Property’s shareholders have approved the disposal of Kiara 163 Retail Park and AEON Seri Manjung for a total of RM422.5m cash to ALX Asset at an EGM. “The disposal will generate an infusion of RM422.5m into the YNH group and this will strengthen our balance sheet while allowing our group to gain more headroom to secure future funding required to finance other exciting projects within our landbank as well as kick-starting our flagship project, Menara YNH,” independent non-executive director Ching Nye Mi said in a statement. (StarBiz)

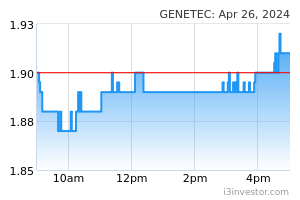

Genetec: ACE-Market listed Genetec proposes transfer to Main Market . After spending almost two decades listed on the ACE Market of Bursa Malaysia, Genetec Technology is now eyeing a move to the Main Market. In a bourse filing, the contract manufacturer of automated industrial equipment proposed a transfer to the Main Market to enhance the company’s credibility, prestige and reputation, as well as accord the group greater recognition and support amongst investors, in particular among larger institutional and foreign investors. (The Edge)

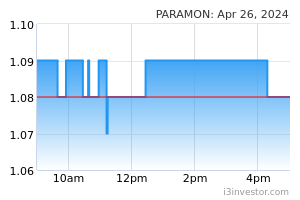

Paramount Corp: To launch RM1.5bn worth of projects in 2023 . On the back of achieving record sales of RM1.1bn in FY2022, Paramount Corp has set out to launch RM1.5bn worth of projects in FY2023. Paramount CEO Jeffrey Chew Sun Teong shared his optimism on the group’s outlook for the current year, citing signs of the property market’s recovery last year. (The Edge)

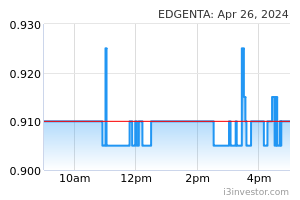

UEM Edgenta: Sees better bottom line for FY2023 despite higher operating costs . Despite facing higher operating costs amid cost-inflation pressure, UEM Edgenta is anticipating a better bottom line performance for FY2023. There has been concern about the group's profit growth due to cost escalation related to higher repair and maintenance costs for some hospitals and incinerator plants, as well as the increase in the minimum wage for the hospital division. (The Edge)

Market Update

The FBM KLCI might open lower today after the yield on 10-year US Treasury notes hit 4% on Wednesday, as traders sold government debt in anticipation of a longer period of higher interest rates. The rise took the yield to the highest point since November. Yields late last year were trading at levels previously reached more than a decade ago. The yield on the 10-year note rose about 0.08 percentage points to 4%, while the return on the two-year note rose 0.09 percentage points to 4.88%, building on a 16-year high reached on Tuesday. Moves in Treasury markets left the so-called yield curve in its steepest inversion in 42 years. An inverted yield curve, in which yields on short-dated bonds are more than those of longer-dated bonds, is often viewed as a harbinger of recession. The blue-chip S&P 500 index lost 0.5% and the tech-heavy Nasdaq shed 0.7%. Europe’s region-wide Stoxx 600 index closed down 0.8%, Germany’s Dax fell 0.4% and France’s Cac 40 dropped 0.5%. The FTSE 100 rose 0.5%.

Back home, Bursa Malaysia slipped again on Wednesday as buying interest remained tepid, with the cautious mood persisting, despite improved sentiment across the region. At the closing bell, the benchmark FBM KLCI had retreated 3.99 points to 1,450.20, from Tuesday’s closing at 1,454.19.

Meanwhile, the regional stocks rallied on Wednesday as robust Chinese manufacturing data lifted investor spirits following muted trading the previous day. Hong Kong’s Hang Seng index closed up 4.2% and China’s CSI 300 rose 1.4%. The figures showed that China’s manufacturing sector expanded at its fastest pace in more than a decade, in an unambiguous signal that its economy was rebounding after the government’s strict zero-Covid policy was lifted.

Source: PublicInvest Research - 2 Mar 2023